While China’s EV exports surge, Chinese automakers are already making moves to dominate services downstream of the physical vehicle—with implications for national and industrial security. Meanwhile, the G7 celebrates the success of its Russian oil price cap, a looming oil deficit, and a wave of consolidation in energy and mining markets. Plus: nuclear fusion and more firms are betting on national security as a guiding investment thesis.

CHINA’S FULL-STACK EV STRATEGY

China’s global automotive ambitions don’t end at the car

China’s electric vehicle exports are booming. Last year, its outbound EV shipments more than doubled 2021 levels. New data released this week show the country’s EV exports from January to April nearly doubled year-on-year. By one count, China surpassed reigning champion Japan as the world’s largest auto exporter in the first quarter.

But China’s EV export boom is just one part of the story. The Chinese auto industry’s broader strategy includes dominating the entire suite of automotive mobility technology.

In recent comments to state media, the China Association of Automobile Manufacturers’ deputy chief engineer Xu Haidong said that on the back of an export wave, direct investments overseas are the next major target for Chinese car companies. Greenfield investments in major battery factories in Europe are one example. And those direct investments, Xu has said, should extend beyond the car itself. They should consolidate Chinese automakers’ existing supply chain dominance and extend downstream to cover fields like EV repairs and servicing, second hand markets, recycling, financial services, car insurance, and automotive logistics.

It’s a compelling business case: Leverage your manufacturing capacity and pricing power in EVs and batteries, and create a vast downstream ecosystem within which to lock in customers. That downstream ecosystem and those customers also promise reams of data.

Another key node of the downstream ecosystem is the car operating system. And Chinese state media make clear that Chinese dominance of automotive operating systems is a matter of national security. As Economic Daily put it this week: “The car operating system will decide our victory or defeat in car intelligence and networking…the vehicle operating system not only plays a top-down role, but also concerns national security and industrial security.”

One relevant example is Geely subsidiary London Electric Vehicle Company’s unveiling this month of its modular EV platform, marking the company’s ambitions of becoming a “leading provider of pure electric global mobility solutions.” The Chinese tech outlet 36Kr notes that this is the first time a Chinese carmaker’s advanced automotive infrastructure has “gone abroad.”

“Ten years ago, a shipping container packed and sent overseas supported the ambition of Chinese auto brands to go abroad,” writes 36Kr. “Nowadays, Chinese auto brands are even more eager to sow technology seeds in overseas markets and let them take root locally.”

FACTORS

FACTORS

FACTORS

FACTORSDeclaring success on the Russian oil price cap

The G7 coalition believes their Russian oil price cap has been largely successful in crimping Moscow’s revenues while keeping oil flowing. Indeed, the cap on Russian crude and refined petroleum products appears to have forced Russia to sell its oil at a discount to international benchmark prices. But it’s nowhere near perfect: India and China are snapping up Russian supplies above the cap, and the price gap between Russian- and non-Russian oil continues to narrow.

A more cynical take on the price cap is that it was never primarily intended to hit Moscow’s war chest, but to ensure that Russia keeps drilling oil. By that measure, it’s been a resounding success—price cap evasions or not.

China’s surging oil demand

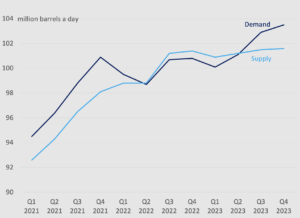

In other oil news: The International Energy Agency expects Chinese oil demand to rebound stronger than expected, having already hit a record 16 million barrels per day in March. The resurgent consumption trend will tighten global supplies and raise prices, the IEA said, even as oil prices have tumbled in recent weeks on recession fears. Moderate growth in China’s power consumption, in line with long-term averages, also indicates recovering economic activity—even as economic data continue to paint a shaky picture of recovery (more on that below).

IEA estimates of global oil demand and supply

Source: IEA, via WSJ

Colorado’s big hydrogen push

The US Department of Energy is currently vetting a couple dozen proposals to build the country’s first “hydrogen hubs,” designed to demonstrate production, transportation, storage, and use of low-carbon hydrogen with the help of 8 billion USD in funding from the infrastructure bill.

One of the contenders is Colorado. And last week, the state legislature passed a bill setting the nation’s first standards for clean hydrogen, putting in place a mechanism to unlock a state-level clean hydrogen tax credit for the use of the fuel—on top of federal Inflation Reduction Act tax credits for the production of clean hydrogen. As Heatmap News put it, this is part of Colorado’s “Inflation Reduction Act 2.0” playbook to supercharge federal funding with state-level incentives.

MARKETS

MARKETS

MARKETS

MARKETSIt’s consolidation time

The US oil and gas sector is poised for consolidation. Last weekend saw the natural-gas focused pipeline operator ONEOK move to acquire the petroleum transporter Magellan Midstream Partners in a 18.8 billion USD deal. As the FT put it: “The deal will create one of the biggest oil and gas infrastructure companies in North America as consolidation in the hydrocarbon business gains pace.”

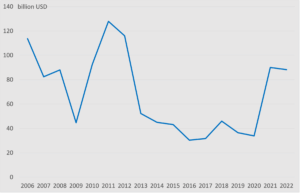

Other sectors producing critical energy and mineral inputs are likely on the cusp of a wave of consolidation, too. Last year saw the most M&A deals in metals and mining in a decade. We discussed the mega Livent-Allkem lithium merger last week. The copper industry is seeing a spate of M&A activity as well. And US gold miner Newmont just sealed a deal to acquire its Australian rival Newcrest this week for 17.8 billion USD.

With volatility in energy markets and a global scramble to secure minerals for clean energy technologies, we may be looking at a period of get big or get bought. That’s not to say smaller companies don’t have a role to play, though. As the Wall Street Journal reports this week, smaller oil exploration and production are moving in to fill a void as oil giants retreat from fossil fuel projects.

Annual global mining sector M&A activity by value

Source: White & Case

China’s economic recovery: still wobbly

Chinese economic data continues to look disappointing, adding to last week’s lackluster trade figures. Industrial production for April rose a mere 5.6%, far short of the 10.9% economists had forecast. And while retail sales jumped 18.4%, it was below the expected 21% increase.

In any case, consumption numbers mask a more troubling reality: Both fixed asset investments and industrial value-added output is down month on month. Without a meaningful recovery in business activity and jobs, any consumption bump will be short-lived.

One metric is seeing significant gains, however: Shipments of intermediate goods to ASEAN nations grew 24% in January-April, faster than overall export growth. The trend is in line with companies’ efforts to diversify manufacturing beyond China, with more production steps now moving to nearby countries.

The national security investment thesis

Private equity firm Cerberus is looking to raise 2.5 billion USD to invest in critical supply chain projects, Bloomberg reports, seeking exposure to “long-term US policy tailwinds” as the White House prioritizes revitalizing the domestic industrial base. Cerberus joins investment firms like Andreesen Horowitz, whose American Dynamism vertical targets technologies that “support the national interest,” in referencing national security to guide their bets.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSNuclear fusion’s super high stakes

Generating large-scale energy from nuclear fusion is “the holy grail…the mythical unicorn,” as Salesforce CEO and fusion energy investor Marc Benioff has put it. It’s also a reality that’s at least several decades away.

Until then, a lot of investment is needed. Between now and when the first nuclear fusion power plants come online, fusion companies will have spent an estimated 7 billion USD in building that supply chain, according to new results from a Fusion Industry Association survey. Japan is placing its bets, too: This week saw Mitsubishi and fifteen other companies committing 74 million USD to the Tokyo-based startup Kyoto Fusioneering.

The bottom line: Fusion could eventually provide near-limitless energy. Just don’t count on fusion from saving us from the immediate climate crisis.

(Photo by Irina Iriser/Pexels)