China has bought half of the world’s biggest lithium assets put on the market since 2018, far more in value than Australia and the US combined. Meanwhile, extreme weather heightens LNG volatility, growing market attention on black mass, Huawei’s semiconductor teaser, and Germany’s economic struggles. Plus: energy market impacts from the coup in Gabon.

UPPING THE UPSTREAM ANTE

China’s global minerals grab

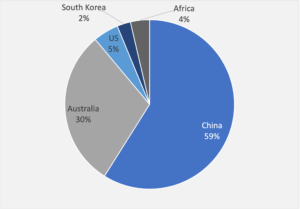

Here’s a startling, if unsurprising, fact: half of the world’s biggest lithium assets put on the market since 2018 have been bought by China, according to S&P Global Ratings.

By value, Chinese acquisitions of the largest lithium mines available for sale were even greater, totaling 7.9 billion USD, or 58% of the total value of the top 20 deals worldwide since March 2018. Australia came in second at five deals totaling 4 billion USD. And the US trailed with three purchases worth 650 million USD.

The trend is clear. Chinese firms are extending their reach further into upstream stretches worldwide, in turn reinforcing existing midstream and downstream dominance. Regions of particular interest are Africa and Latin America, where Chinese players have acquired stakes in dozens of primary lithium projects. All this strengthens China’s hold on supply chains—and leverage over the global energy transition.

Global top 20 lithium M&A deals since 2018, by value

Source: S&P Global

FACTORS

FACTORS

FACTORS

FACTORSStress ahead in the natural gas market

Global LNG prices are down from last year’s peaks, but extreme volatility—driven by underlying fragility—remains. For weeks, markets have grappled with the threat of major looming strikes at LNG facilities in Australia. Extreme weatheradds still another wrinkle. That’s especially so as stronger and more frequent hurricanes hit the US, potentially disrupting LNG exports.

Plus, the stakes are higher than ever. US exports of the liquefied fuel have grown 10-fold since 2016. Meanwhile, global LNG import capacity is set to expand 16% by the end of 2024 compared to 2024. Increasingly, that means a single disruptive event at a major LNG exporting country can cause major energy market gyrations around the world. Tokyo Gas, for one, is bracing for the possibility of price spikes this winter.

Not all sunshine and rainbows

Solar panel shipments in the US hit a record high in 2022, growing 10% from the year prior to set an annual record of 31.7 million peak kilowatts, according to the Energy Information Administration’s latest data. Shipments include imports, exports, and domestically produced and shipped panels. Still, domestic manufacturing capacity remains limited: last year, nearly 90% solar panel shipments were imported, mostly from Asia

Meanwhile, headwinds in America’s offshore wind sector. The first-ever auction for wind farm rights in the Gulf of Mexico saw exceedingly low interest, attracting a single winning bid for one lease. Two other leases got zero bids. As CEO of Denmark’s Orsted put it this week: “The situation in U.S. offshore wind is severe.”

All eyes on black mass

Black mass is a dark, powdery mix of metals like lithium, cobalt, manganese, and nickel, produced from shredding and crushing waste batteries for reuse in new battery production. And there’s growing interest in the material. Just this week, Platts launched a spot physical black mass price assessments for the US.

But the economics of battery recycling are tricky. Weak lithium prices are weighing on black mass prices, which means thinner margins for recycling companies that sell their material into the lithium market.

MARKETS

MARKETS

MARKETS

MARKETSGina Raimondo’s China visit….

US commerce secretary Gina Raimondo wrapped up her four-day visit to China this week. There were no big surprises and no new deals. She reiterated the White House’s position that US national security concerns are non-negotiable, and relayed American businesses’ concerns that China is increasingly “uninvestible.” Perhaps the most concrete achievement was both sides’ agreement to set up a working group to discuss trade and investment issues, and Raimondo’s commitment to exchange information with Beijing on US export control enforcement.

…and Huawei’s chips teaser

But as we’ve noted repeatedly, current US trade and investment restrictions are riddled with loopholes. And Huawei’s surprise launch of a high-end smartphone seems to hint at just that: speculation is rife over whether it has managed to develop and produce its own 5G chips in spite of US restrictions. It’s also possible, of course, that Huawei is using stockpiled TSMC chips before restrictions kicked in. Whatever the case may be, we know that Huawei has invested heavily in chip research and production.

No sign of economic rebound, yet

The challenges keep piling on for Germany. Inflation rose in four of six key German states in August, suggesting a longer slog ahead in the fight against price rises. Unemployment rose more than expected. Manufacturing is headed in the opposite direction: August’s PMI clocked in at 39.1, the second lowest reading since May 2020. Some consolation: as a whole, the euro zone’s manufacturing downturn showed signs of easing.

Meanwhile, more signs of weakness in China’s economy. Factory activity shrank for a fifth straight month in August, with the PMI hitting 49.7—a slight improvement from July’s 49.3, but still in contraction territory. The slowdown is also weighing on export-oriented economies elsewhere: South Korea’s semiconductor shipments fell sharply last month, for example.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSAfrica’s wave of coups

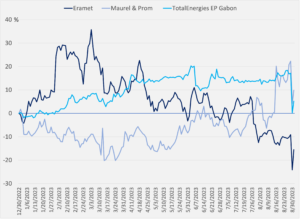

This week’s coup in OPEC member Gabon is the eight in West and Central Africa in only three years, and comes merely weeks after another one last month in Niger. The two most recent coups have taken place in oil producing countries. That has oil markets on their toes as traders brace for signs of potential supply disruption. Companies with Gabon operations, like French mining group Eramet, oil and gas producer Maurel & Prom, and a listed unit of TotalEnergies, all sank in Paris trading.

Source: Investing.com

(Photo by Pixabay/Pexels)