New poll results show that the US public backs revoking China’s PNTR status, immediate economic consequences be damned, and markets should take heed. Plus: Nord Stream sabotage, the LME considers banning Russian metals, Chinese battery and EV firms are snapping up global lithium supply (from the very players trying to mitigate supply chain dependence), and the US needs to step up gas production.

THE BIG POLL

The US public thinks it’s time to end China’s PNTR status

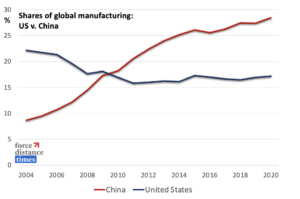

This week’s big story is from us: A July 2022 poll sponsored by Force Distance Times found that the plurality of likely US voters favor ending China’s Permanent Normal Trade Relations status, and 2-1 support among Republicans – all at the height of inflation. This aligns with a broader anti-China shift in US public opinion. But the PNTR findings are remarkable, even surprising, because they suggest that the anti-China shift holds even when it comes with economic consequences, and amid economic turmoil at that. As such, these poll results underscore the political as well as strategic incentive to address China’s PNTR status – a move that would have tremendous, and currently unacknowledged, market implications.

PNTR, previously called Most Favored Nation, status is a designation granted by the US as a part of free trade. The receiving nation is awarded all trade advantages granted any other nation. Washington gave China PNTR status in 2000 so that it could join the World Trade Organization, based on the assumption that doing so would, as President Bill Clinton put it, make the US richer, China freer, and the world more peaceful. The opposite happened: Free trade with China facilitated the hollowing out of US industry, Beijing’s distortion of international markets, and its domestic authoritarian stranglehold.

These realities have been clear for decades – and to leaders from across the political spectrum. In 2005, Senator Bernie Sanders led an effort to repeal China’s PNTR status; in 2021, Senators Tom Cotton, Jim Inhofe, and Rick Scott introduced a bill to do the same. What has been less clear is where public will stands. The immediate, conventional response to any proposal to revoke China’s PNTR status is that it would be too expensive; that the American consumer wouldn’t stand for it. But Force Distance Times’s poll found that the American voter supports revoking China’s PNTR status, even if that risks exacerbating short-term inflation and supply chain pressures.

Source: World Bank

This creates political incentive. It makes addressing China’s PNTR status a realistic possibility. Doing so would open the door to systemic, strategic economic and industrial competition with Beijing – moving beyond the current whack-a-mole approach. That is a territory that US corporate and financial sectors are not currently preparing for and markets are not currently pricing in: It would entail unprecedented and unexpected headwinds for players with outsize reliance on China for production, capital, or revenue.

FACTORS

FACTORS

FACTORS

FACTORSThe US needs to ramp up gas production

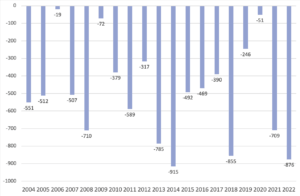

As gas leaks into the Baltic Sea and Europe faces the prospect of acute fuel shortages this winter, the US has massively stepped up exports of LNG. Yet production has not kept pace. According to new figures from the US Energy Information Administration, domestic dry gas production totaled 17,329 billion cubic feet in the first six months of the year. Over the same period, however, consumption rose by 440 bcf, and exports soared by 1,408 bcf. That’s squeezing domestic supplies, as can be seen from a sharp depletion of underground storage facilities. Inventories were down 876 bcf in the period from January to June this year—the second-largest on record and 65 percent higher than the average over the past decade, according to Reuters’ John Kemp. Gas producers will have to significantly increase output if they are going to maintain critical exports to Europe while meeting domestic needs.

US natural gas withdrawals from storage, bcf, January-June 2002-2022

Source: US Energy Information Administration via @JKempEnergy

Chinese battery and EV firms are snapping up lithium

Chinese EV maker Nio is getting into the lithium sourcing game. This week, Australian lithium miner Greenwing Resources disclosed in filings that Nio will pay 12 million USD for a 12.16 percent stake in the company at A$0.55 a share—a handsome 124 percent premium to the last closing price. The bulk of the investment will finance Greenwing’s San Jorge lithium project in Argentina’s Catamarca province, with Nio potentially being an offtake partner when the mine comes online.

The move makes Nio one of the few EV makers (alongside Tesla) to be directly sourcing raw inputs from miners, instead of battery companies. And Nio will be needing a lot of lithium: It plans to manufacture its own battery packs, developed in-house, by 2024. That will put it in direct competition with battery makers like CATL, another Chinese giant, which themselves have aggressively staked out upstream investments to secure raw material supplies. To wit: CATL’s acquisition last year of the Toronto-listed Neo Lithium, whose Tres Quebradas project is not far from Greenwing’s (pdf, p.3).

This leads to a broader question of whether companies in the West should be selling stakes in strategic mineral resources to Chinese firms at the same time as they aim to reduce reliance on China for their own battery supply chains. Western Australia, for example, says it hopes to become a major battery manufacturing hub. For that, it will need a lot of lithium—demand for which is slated to far outstrip supply in coming years, as Rio Tinto’s chief warned this week. Ceding control over upstream nodes to China won’t help.

The LME considers banning Russian metals

The London Metal Exchange is taking steps to assess whether and in what situations it would ban new Russian metals from its network of warehouses, Bloomberg reported this week. The possibility that a major metals exporter would be banned from the exchange sent prices of aluminum, nickel, and zinc up multiple percentage points. Within hours, the LME, which is owned by Hong Kong’s bourse operator, had confirmed the veracity of the report.

More turbulence in global metals markets looks likely, then. Banning Russia would knock out a big chunk of supply and could complicate buyers’ multiyear supply contracts with firms like Nornickel and Rusal. Not banning Russia could enable the country to dump massive amounts of excess aluminum—spurned by European buyers—onto the exchange, potentially distorting the global benchmark market.

MARKETS

MARKETS

MARKETS

MARKETSNord Stream sabotage

Four separate as-yet-unexplained leaks in Nord Stream 1 and 2 pipelines in the Baltic Sea are the latest chaotic, high-stakes twists to Europe’s evolving energy crisis. The EU suspects sabotage, though it has yet to name a suspect. Washington says it’s too early to say for sure, though it “seems” Russia is to blame. The Kremlin suggests the US is the culprit.

A core tenet of Russian military strategy is to destroy critical infrastructure to inflict physical and psychological damage on the enemy. If Russia is indeed responsible for the Nord Stream leaks, as seems likely, then this week’s sabotage operations could well be a thinly veiled hint that they might similarly target other critical infrastructure—like the newly inaugurated Poland-Norway Baltic Pipe, or the LNG terminals that Europe is scrambling to install. And it wouldn’t just be energy that takes a hit: A severe power crunch this winter could risk widespread mobile network blackouts in Europe. Targeting energy infrastructure also threatens telecommunications infrastructure.

Meanwhile, the implosion of Europe-Russia energy relations is forcing the EU to seek out alternative sources. As we noted last week, this has meant quite the field day for Chinese solar panel producers. But it’s not just solar panels. Chinese exports of heat pumps to the EU have also increased, rising 33 percent in value between January and August this year.

The pound takes a breather after taking a beating

A week after British chancellor of the exchequer Kwasi Kwarteng unveiled a volley of unfunded tax cuts, sparking a precipitous plunge of the sterling, the UK’s currency has erased almost all its losses since the “mini budget” shock. This is in large part a function of desperate Bank of England activities: The BoE this week did its version of Mario Draghi’s famous “whatever it takes” speech, pledging bond purchases “on whatever scale is necessary.”

But while the BoE’s intervention has rescued the pound for now, volatility is still more than a little high, the pound is down almost 8 percent over the past three months, and the UK’s economic outlook remains gloomy. Plus, economic turmoil seems to be spilling into social turmoil. The past days have seen escalating protests across the United Kingdom. The specific causes run the gamut, ranging from the cost-of-living crisis to climate policies to inflation exacerbated by the latest economic package. The one constant: People aren’t happy.

Plus, there’s an added wrinkle at the intersection of society and economics: Fresh strikes at the UK’s busiest port, threatening supply chain snarls that will push up prices. Union workers at the Port of Felixstowe began a strike on Tuesday that will last through Wednesday October 5. They are asking for pay raises to match inflation, currently at 9.9 percent.

A small victory at the ITU

The International Telecommunications Union has a new secretary-general: Doreen Bogadan-Martin of the US State Department decisively defeated her Russian competitor to take charge of the UN agency that sets global standards for cutting edge technologies and shapes the development of the internet.

The election had been framed as a showdown between two visions of the internet, one defined by open standards and in line with liberal democratic values, the other defined by authoritarian surveillance. That contest is indeed playing out, but ultimately it’s not the ITU secretary-general — who doesn’t determine policy — who will decide the future of the web. This week’s vote is a reassuring rebuke of Russia by UN member states. But the fight to limit authoritarian countries like China and Russia’s sway over the global technical architecture is far more complicated, and continues apace.

DISRUPTORS

DISRUPTORS

DISRUPTORS

DISRUPTORSHurricane Ian Strikes

Hurricane Ian is causing severe supply chain disruptions as the storm pummels Florida. At least 2.6 million people in the state are without power, and economic consequences will ripple in the weeks ahead. Already, key transport infrastructure including roads, bridges, and ports have been washed out or shut down. Factories and farm production have taken a hit. Everstream Analytics, a consultancy and data provider, forecasts the storm will impact nearly 10,000 firms across fields including aerospace, automotive parts, heavy machinery, chemicals and plastics, pharmaceuticals, medical devices, and diagnostics. Extensive damage of crops including citrus, soybeans, and cotton threatens to drive up prices. All in all, the damage will be extensive and expensive, expected to cost as much as 70 billion USD in economic damage for Florida alone.

Protests in Iran enter third week

Protests in Iran broke out in September, when 22-year-old Mahsa Amini died in the custody of Iran’s so-called morality police. Now, they are entering their third week – and the conflict is growing more violent. On Friday, near the border of Pakistan, gunmen killed 19 people in what has been labeled a terrorist attack on police stations. Islamist rebel group “Jaish al-Zulm” has claimed responsibility. It remains unclear how precisely this attack fits into the broader protests going on in the country. But it is clear that unrest is building on itself, and the government is striking out in response: Also on Friday, Iran’s Intelligence Ministry reported that it had arrested 263 people, including nine Europeans, over the protests.

This escalating conflict could pose a real challenge to the Iranian regime. The corresponding volatility and scrutiny also threaten the new nuclear negotiations between US and Iran, with them the place of Iranian energy in international markets. The latest, on that front: On Thursday, the Biden administration imposed sanctions on nine entities, including a Chinese crude-oil storage operator, accused of violating restrictions on Iranian oil exports. The move has alternately been framed as a sign that the effort to negotiate with Iran is dead and one that Washington is playing hardball to revive it. Regardless, it underscores the reality that the bilateral US-Iran relationship is anything but.

(Photo by cdrin/Shutterstock)