a/symmetric: China-Australia rare earth intrigue

June 6, 2024Digging into a Chinese investor with state ties

a/symmetric: China’s global rare earths shopping spree

December 22, 2023Shenghe Resources snaps up strategic assets in Canada and Tanzania, and gains still more leverage over global rare earth supply chains.

Deglobalization Round-Up: November 24, 2023

November 24, 2023A US asset manager sees opportunity in China—even as over three-quarters of the foreign money invested in Chinese stocks this year has left. Meanwhile, China ships out small amounts of gallium and germanium, the EU signs its anti-coercion tool into law, and the FT’s Ruchir Sharma argues that it’s a “post-China world now.”

The Week That’s Done: Global minerals grab, LNG turbulence

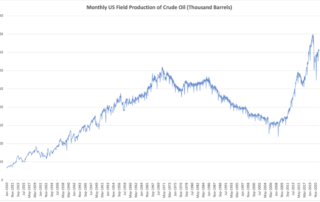

September 2, 2023China has bought half of the world’s biggest lithium assets put on the market since 2018, far more in value than Australia and the US combined. Meanwhile, extreme weather heightens LNG volatility, Huawei’s semiconductor teaser, and Germany’s economic struggles. Plus: energy market impacts from the coup in Gabon.

Indium phosphide could be critical to China’s semiconductor ambitions

July 26, 2023Gallium and germanium have stolen the headlines. But indium phosphide warrants attention, too. China is eyeing the compound semiconductor material as an opportunity to shake off dependence on foreign semiconductor technology, and in turn a point of leverage over global semiconductor supply chains.

The Week That’s Done: Critical minerals midstream risks, Germany’s China strategy

July 14, 2023Global investments in critical minerals are booming, but the midstream processing segment is still dominated by China—which in turn is diversifying its upstream supplies and intensifying competition over mining assets worldwide. Meanwhile, Europe’s industrial natural gas use falls, China muscles into LNG re-exports, and Germany unveils its new China strategy.

The Week That’s Done: China bans Micron

May 28, 2023Big Oil is here to stay, for now—but it’s hedging its bets with investments in Big Shovel, while Big Auto wants minerals in spades. Meanwhile, Asia gobbles up Russian fuels, China bans Micron as Nvidia soars, and the US economy faces tough choices. Plus: How a drying Panama Canal could derail global LNG markets.

The Week That’s Done: China’s industrial strategy

March 19, 2023We give you a blueprint of China's industrial strategy and will a Guinean iron ore mine help China slash dependence on Australian imports? Meanwhile, the EU unveils a critical minerals plan just as China tightens its grips on cobalt and lithium, Black Sea Grain deal uncertainty, and trade controls served two ways.

The US is Vulnerable in Critical Minerals. But There Is a Solution.

February 26, 2023The US is at least 50 percent import dependent for 26 out of the 32 minerals that the 2022 US Geological Survey publishes data on, or 81.25 percent. Of those, China is the top source of US imports for 11, or 42.3 percent. Gallium underscores how severe this dynamic is.

Deglobalization Round-Up: January 27

January 27, 2023Slumping demand for Chinese goods hits international shipping, Apple moves away from China, and Senate legislation would ban Strategic Petroleum Reserve sales to China. Phoenix Tailings's co-founder, Canada's Minister of Natural Resources, and India's industry minister say they're ready for reshoring.

We Can’t Build a Clean Economy Without Investment in Critical Minerals

January 5, 2023Accelerated production of copper, and other critical minerals, is necessary to make clean energy options economically viable. Otherwise, the gap between supply and demand will fuel further price increases on all critical minerals – which will make the energy transition more expensive and less competitive.

The Week That’s Done: November 6

November 6, 2022Beijing completes its space station and we benchmark the US-China space race – while the Fed keeps hiking, Maersk adds to recession fears, the Black Sea grain deal falters, and Canada orders Chinese lithium companies to divest. Plus: an OPEC for battery minerals?

The Week That’s Done: October 30

October 30, 2022US critical mineral capacity remains critically inadequate, China buys up Indonesia’s cobalt, and what are the prospects for made in USA uranium? Plus, US GDP grows, but pain under the surface, tech players crumble, and manufacturing stalls.

The US Is Vulnerable in Critical Minerals. But There Is a Solution.

October 24, 2022The US is at least 50 percent import dependent for 26 out of the 32 minerals that the 2022 US Geological Survey publishes data on, or 81.25 percent. Of those, China is the top source of US imports for 11, or 42.3 percent. Gallium underscores how severe this dynamic is.

The UK’s New Critical Minerals Strategy Represents a Comeback for Industrial Policy

July 28, 2022The UK government is now demonstrating that it is ready to move, and in lockstep with allies, in setting out the steps to maximize what the UK produces across the value chain and to reduce strategic dependence on China.

We Can’t Build a Clean Economy without Investment in Critical Minerals

June 23, 2022Accelerated production of copper, and other critical minerals, is necessary to make clean energy options economically viable. Otherwise, the gap between supply and demand will fuel further price increases on all critical minerals – which will make the energy transition more expensive and less competitive.

Factors Briefing: Week of May 16

May 21, 2022In a new era of shortage, adjustments are being made: Food nationalism rears its head in India, while in critical minerals automakers look to platinum over palladium; meanwhile, the US fails to incentivize greater oil and gas production while China scoops up Russia's at bargain basement prices

Factors Briefing: Week of May 9

May 14, 2022It's shortage everywhere: In agriculture, wheat is the latest victim, threatening tomorrow's food supply while a baby formula shortage wreaks havoc today; meanwhile, China eyes the aluminum vacuum and a South Korea x Canada collab tries to shore up tungsten dependencies.

Factors Briefing: Week of April 18

April 24, 2022Indonesia works to climb the nickel value chain while Mexico nationalizes its lithium reserves; fertilizer shortage injects new, cross-cutting threats into the global food market; and nuclear energy comes back into favor -- but how to source the uranium?

Markets Briefing: Week of April 4

April 8, 2022Canada wakes up -- kind of, and slowly -- to the risks of foreign investment in strategic areas; elsewhere, it's EVs, EVs, and EVs, but without commensurate attention to the upstream

Factors Briefing: Week of March 28

April 1, 2022The Biden Administration's SPR release fails to address supply gaps -- but invocation of the Defense Production Act for critical minerals maybe does; Canada's abundant resource supply pushes it to the big stage in a new geopolitical environment