How China sees the global energy competition

June 14, 2024To a greater degree than the US, China treats energy not only as a matter of security but also a competitive domain. For Beijing, energy is not merely a question of security: having sufficient energy supplies to meet demand. It is also a contested realm: one in and through which to project power, acquire leverage, and exact concessions.

Competing for Fuel: Benchmarking the US-China Energy Competition

June 14, 2024Both the US and China acknowledge that energy shapes global economic development and security – and, accordingly, assess their national power based on their energy status. This report seeks to assess the current US-China competitive playing field in the energy domain, benchmarking US and Chinese standing in the field.

The US Aluminum Production Challenge and How to Fix It

March 30, 2023Without action to stabilize the aluminum industry, the United States is at risk of increasing its reliance on China, Russia and the UAE for critical infrastructures, military needs, and clean technologies. And without a robust energy supply, the US will not be able to stabilize the aluminum sector.

The Week That’s Done: December 25

December 25, 2022Geopolitics goes back to basics: Zimbabwe bans lithium exports, the EU imposes a(n easily evaded) gas price cap, China and India snap up cheap Russian fuels, and the US moves forward on a strategic uranium reserve. Plus Myanmar and Russia coordinate on nuclear energy, the Bank of Japan shocks investors, and the US turns to Africa.

The Week That’s Done: December 18

December 18, 2022New strains hit Europe’s energy systems while the US fights to invest in next generation solutions, and struggles at the upstream. Plus, a breakthrough in nuclear fusion, hope that inflation might be easing (kind of), Japan’s new defense strategy, and more.

The Week That’s Done: November 27

November 27, 2022There’s new progress in the ex-China rare earths supply chain, but is it enough? Plus: Energy turmoil as Europe’s bans on Russian oil and diesel loom; strikes threaten US, South Korean, and UK logistics; China’s back in lockdown; Taiwan has an election surprise; and the OECD summarizes things neatly with a gloomy outlook.

The Week That’s Done: November 13

November 13, 2022The EU’s ban on Russian petroleum products is a mere weeks away, winter looms, and the energy crisis is a global affair – with developing economies on the frontlines. Plus, deflation in China, competition in major metal exchanges, and the neon market heats up while palm oil cools.

The Week That’s Done: September 11

September 11, 2022A deep dive into Europe’s energy crisis shows faltering industry and political fault-lines, no end in sight for Moscow’s economic warfare, and Beijing as the real winner – plus Europe intent on doubling down on its own mistakes. In markets, a weak currency could strengthen China’s hand, elsewhere it’s hikes hikes hikes, and will India join a major global bond index?

Security-Centric and Climate-Inclusive: Energy Policy for an Era of Great Power Politics

August 7, 2022The world is witnessing the first great power military challenge to the US-led liberal international order—an order that Russia and China have long sought to discredit and dismantle. This moment be seized upon to reorient Western thinking from its climate-centric mindset to one that’s security-centric and climate-inclusive

The Week That’s Done: July 24

July 24, 2022The EU's twin energy and economic crises threaten the bloc's cohesion, also political losses on those struggling to hold it together. Plus: Inflationary pressures mean no tariffs on Russian fertilizer, dumping be damned; the EV revolution strengthens China's auto hand; monkeypox is a global health emergency; and more fun fun fun.

The Week That’s Done: June 26

June 26, 2022With the energy crisis here to stay, the White House is throwing Econ 100 to the winds; Europe on a quest for new supply; and China sitting pretty atop cheap Russian imports that promise new energy influence, and leverage over the West. Meanwhile we round out the week with economic collapse in Sri Lanka, a COVID pill in China, and a looming critical mineral shortage.

The Week That’s Done: June 19

June 20, 2022Washington brings supply-side tools to a demand-side fight; the EU fares no better. Meanwhile Moscow turns off gas to Europe while Beijing continues to snipe chip tech. Plus: All eyes on Xinjiang, the Yen, and the WTO's pyrrhic victory.

The Week That’s Done: June 5

June 5, 2022The EU promises that it will block most Russian oil imports maybe – all while production continues to stall and Australia offers worrying indicators of shortage ahead; plus we have European inflation, car companies as space companies, and a pyrrhic victory for the US.

Factors and Markets Briefing: Week of May 23

May 29, 2022With record gas prices, squeezed agricultural producers, and stubborn labor crisis, the era of shortage is here to stay -- and likely worsen. Cue shifting consumer habits, Sri Lanka's default, and a move toward industrial integration (anti-trust be damned). Happy Memorial Day!

How Washington Can Resolve the Energy Crisis — for Today, and Tomorrow

May 23, 2022If Secretary Granholm wants more energy production, she should orient her relationship to industry around reshaping incentives to align tomorrow’s demand with today’s supply. She should make clear that incentives for increased production will continue next month, and the months after.

Factors Briefing: Week of April 18

April 24, 2022Indonesia works to climb the nickel value chain while Mexico nationalizes its lithium reserves; fertilizer shortage injects new, cross-cutting threats into the global food market; and nuclear energy comes back into favor -- but how to source the uranium?

Want an Energy Revolution? Try Investing in It

April 24, 2022The green economy constitutes a multi-trillion dollar market opportunity. It’s also an opportunity for geo-economic power: With appropriate and sufficient investments, a country can maneuver to control tomorrow’s supply chains and manufacturing capacity, and therefore to project influence internationally.

Markets Briefing: Week of March 28

April 2, 2022The EU makes a long-shot bid for gas market leverage; the Commerce Department wises up to China's solar tariff circumvention; and China's Securities Regulatory Commission looks to cozy up to the SEC

Factors Briefing: Week of March 28

April 1, 2022The Biden Administration's SPR release fails to address supply gaps -- but invocation of the Defense Production Act for critical minerals maybe does; Canada's abundant resource supply pushes it to the big stage in a new geopolitical environment

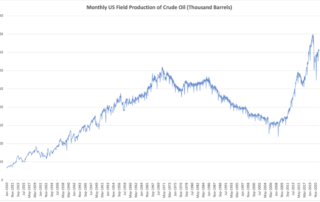

It’s Not Too Late for Washington to Learn Supply and Demand

April 1, 2022Russia’s invasion of Ukraine has shown that the US cannot afford to depend on geopolitical adversaries for critical factors. Instead, the US should be investing in domestic production that can not only prop up national resilience, but also that of allies and partners.

Your March 25 Briefing

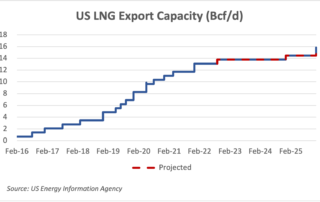

March 25, 2022Moscow teases decoupling, the London Metal Exchange braces for defaults, and the US faces an LNG squeeze.

When Promises Aren’t Enough: An LNG Roadmap

March 25, 2022Producing things is difficult and Washington has been out of the game for some time. But producing things is also possible. And Washington needs to get back into the game, yesterday. We can start with LNG -- and actually help Europe in the process.