a/symmetric: Decoding China’s industrial system

August 24, 2024On big picture context and frameworks, and finding signals from noise

a/symmetric: Tallying China’s innovation

August 17, 2024Beijing wants to direct money towards the most innovative firms

a/symmetric: China’s Starlink bets

August 10, 2024China launched the first satellites of its megaconstellation. The effort is aimed at a grand prize: 6G leadership

a/symmetric: Dawn of the supercomputing internet

July 12, 2024China aims to leverage networks, not just computers, to win the supercomputer race

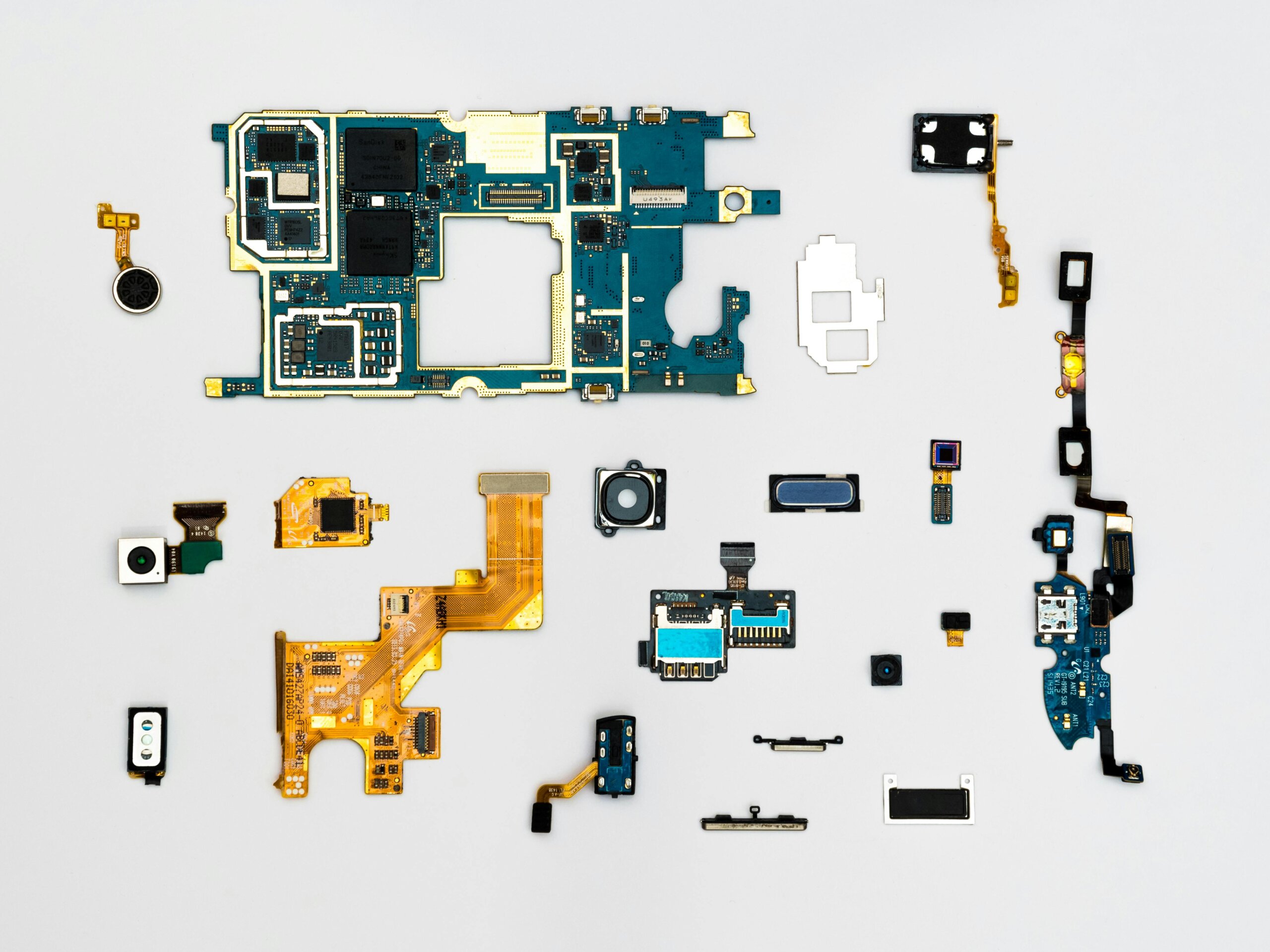

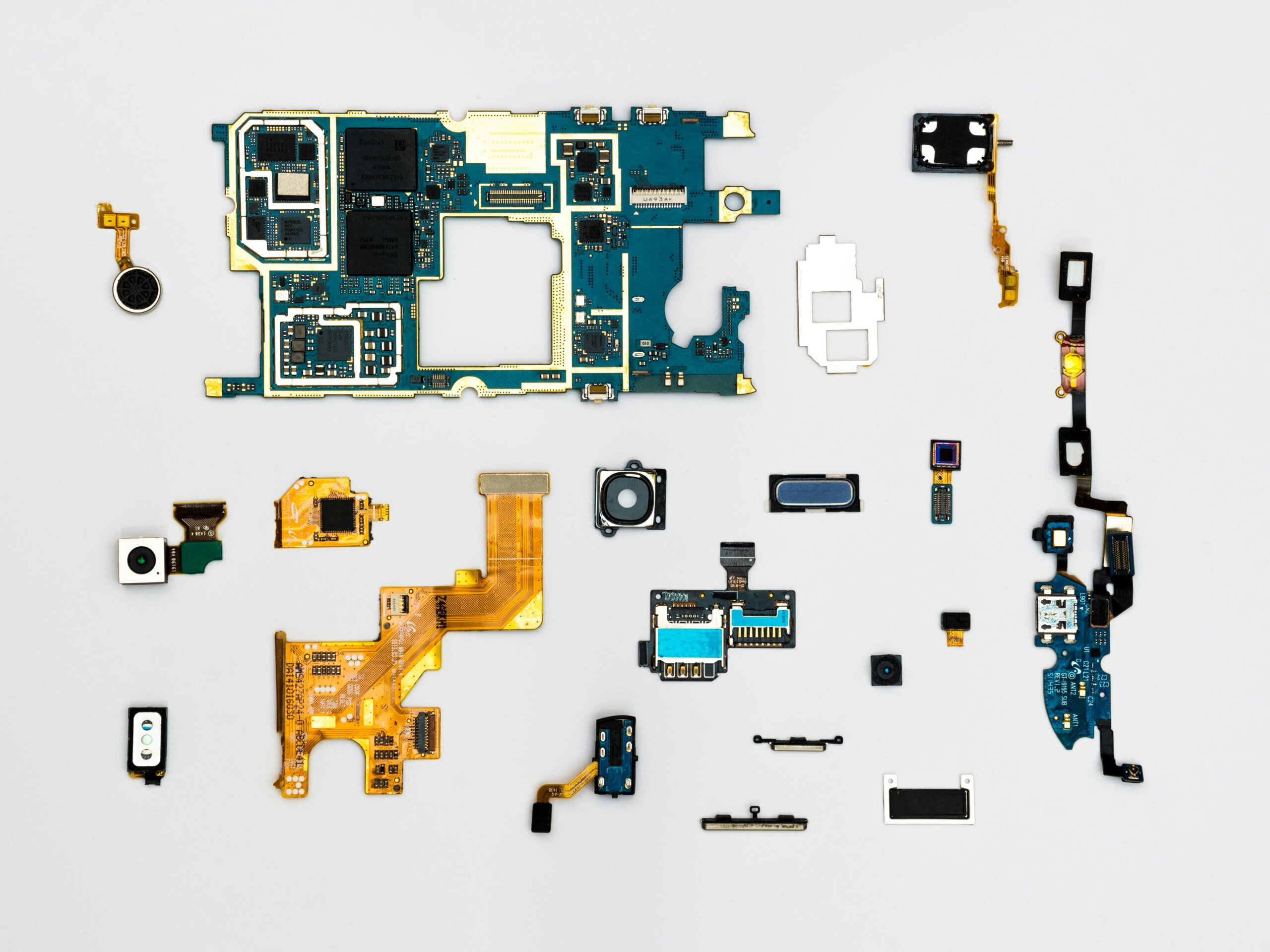

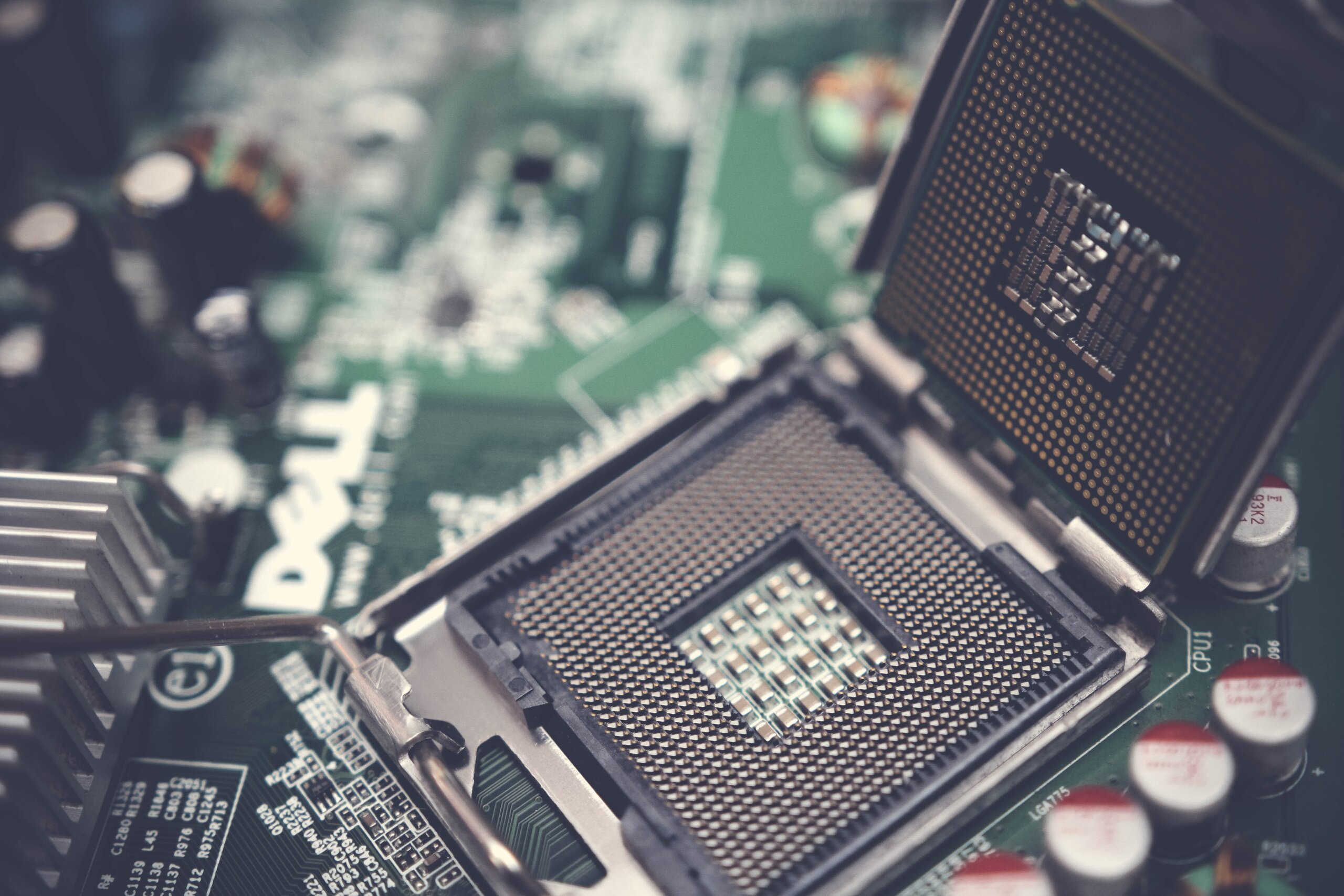

a/symmetric: Measuring the resilience of AI industrial chains

July 8, 2024Import dependence is only one measure of countries’ relative strengths and weaknesses in AI.

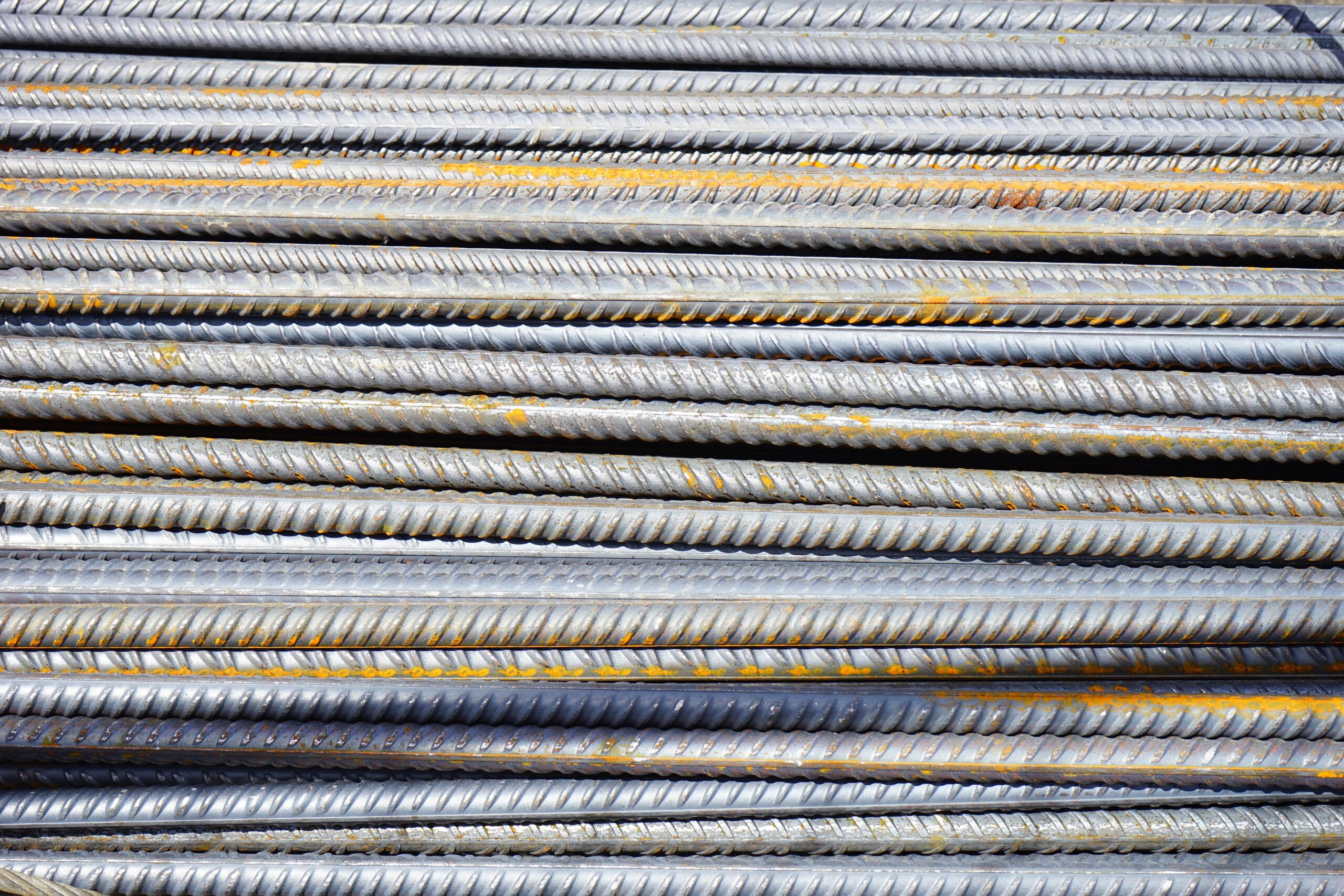

a/symmetric: The industrial basics of critical tech

May 25, 2024Why it’s important to control “the thing to make the thing to make the thing to make the thing”

a/symmetric: China’s second mover advantage?

May 18, 2024Reactions to GPT-4o, and other observations on the AI race

a/symmetric: How China innovates

May 11, 2024It prioritizes industrializing technology, transforming scale into market power.

a/symmetric: Missing the swarm for the drones

May 5, 2024Washington risks repeating its Huawei mistakes with DJI

a/symmetric: China bets on industrial AI

April 27, 2024Doing so sidesteps its US tech dependence and amplifies its manufacturing might

a/symmetric: Germany: China’s useful idiot?

April 20, 2024Chancellor Olaf Scholz wants to thread a fine needle on China. But the asymmetries in Sino-German ties, strategies, and priorities make that a tall challenge.

The Week That’s Done: outbound investment screening, industrial policy

August 13, 2023Call it industrial policy, state intervention, or marketcrafting: governments have realized that market forces alone won't address economic security and supply chain risks. Meanwhile, LNG volatility spikes, offshore wind investments slump, and the White House targets investment in Chinese tech. Plus: global food turmoil.

The Week That’s Done: Climate competition, manufacturing FDI

July 23, 2023Can climate cooperation reset US-China relations? Probably not. Meanwhile, the US works to onshore a graphite supply chain, Russia threatens global food supplies, the UK gets a second gigafactory (with a dose of China dependence).

The Week That’s Done: Critical minerals midstream risks, Germany’s China strategy

July 14, 2023Global investments in critical minerals are booming, but the midstream processing segment is still dominated by China—which in turn is diversifying its upstream supplies and intensifying competition over mining assets worldwide. Meanwhile, Europe’s industrial natural gas use falls, China muscles into LNG re-exports, and Germany unveils its new China strategy.

The Week That’s Done: China flexes its upstream muscles

July 8, 2023Gallium and germanium stole the headlines this week. The even bigger headline: China’s asymmetric play underlines the importance of investing in upstream resources. Meanwhile, Europe dubs aluminum a critical raw material, Moderna takes a chance of the China market, and Toyota claims a battery breakthrough.

The Week That’s Done: China puts US companies on notice

July 2, 2023Beijing’s new laws increase the already high risks for foreign firms doing business in China—so will companies take the hint? Meanwhile, a US air conditioning startup partners with a Chinese battery giant, raising questions about potential commercial and potential risks.

The Week That’s Done: EU economic security, US EVs head to China

June 27, 2023Europe tries a difficult economic security balancing act—while simultaneously deepening ties with China in strategic sectors. Meanwhile, CATL goes upstream into lithium, Middle Eastern state firms go downstream into EVs, and foreign carmakers head to China. Plus: can spin-offs brush off geopolitical risk?

The Week That’s Done: China’s stimulus, Toyota’s pivot

June 18, 2023China turns on the stimulus spigot, the US takes a pause, Europe hikes, and Japan stays as dovish as ever. Meanwhile, oil demand is sticky and it’s boom time for LNG. Plus, Toyota’s strategic pivot and France’s push for tariffs on Chinese EVs.

The Week That’s Done: Chinese takeovers, Sequoia splits

June 11, 2023Italy is reckoning with Chinese corporate influence — but damage can be hard to undo, and interventions now can prove too little too late. Just ask Pirelli. Meanwhile, Saudi Arabia’s production cut sweetens business for some and slashes profits for others, Sequoia splits three ways, and China flirts with deflation. Plus: more West Coast port uncertainty.

The Week That’s Done: Beijing woos CEOs, snubs US defense chief

June 4, 2023China gives global CEOs a warm welcome, but the US defense secretary the cold shoulder. At the same tie, follow the money: Global investors are cooling on China. Plus: Saudi Arabia and Russia, Japan and wind, cathodes and anodes.

The Week That’s Done: China bans Micron

May 28, 2023Big Oil is here to stay, for now—but it’s hedging its bets with investments in Big Shovel, while Big Auto wants minerals in spades. Meanwhile, Asia gobbles up Russian fuels, China bans Micron as Nvidia soars, and the US economy faces tough choices. Plus: How a drying Panama Canal could derail global LNG markets.

The Week That’s Done: China’s Full-Stack EV Strategy

May 21, 2023Chinese automakers are making moves to dominate downstream auto services — with implications for national and industrial security. Meanwhile, the G7 celebrates the success of its Russian oil price cap, a looming oil deficit, and a wave of consolidation in energy and mining markets. Plus: more firms are betting on national security as a guiding investment thesis.

The Week That’s Done: A Mega Lithium Merger

May 14, 2023It’s not every week that the largest ever lithium deal gets inked–and more consolidation could be on the horizon. Meanwhile, Argentina wants to be a copper major, Australia wants to ride the hydrogen commodity boom, and Canada is struggling to monitor mining investments. Plus: A look at Rockwell Automation’s China footprint.

The Week That’s Done: China’s Midea eyes Sweden’s Electrolux

May 7, 2023A Chinese home appliance giant wants to acquire a Swedish home appliance brand—and it’s not as mundane as it seems. Meanwhile, China goes big on oil drilling, positions to leapfrog on EVs, and cements (steels?) its partnership with Riyadh. Plus: Rate hikes, another Goldilocks jobs report, and EV makers’ direct sourcing ambitions.

The Week That’s Done: Updating America’s Industrial Strategy

April 30, 2023Washington and its allies are questioning the orthodoxy of globalization. Meanwhile, Russia ropes Turkey into its nuclear orbit, China continues its attack on foreign businesses, and the global aluminum market hinges on rains in Yunnan. Plus: Risk of a Marburg epidemic and improving global health security with small vaccine stockpiles.

The Week That’s Done: Chile wants to nationalize lithium

April 23, 2023Is the West buying laundered Russian oil? Plus: Caveats to China's GDP rebound, copper supplies are tightening, Chile wants to nationalize lithium, hurdles for US LNG projects, and CXMT's IPO.

The Week That’s Done: Mega sites for mega factories

April 16, 2023US manufacturing is booming—but companies need factory space. Meanwhile, Tesla doubles down on China, Indonesia wants to join the US EV tax credit party, and a wheat blast disease pandemic could threaten global food security.

The Week That’s Done: Can Europe de-risk its China ties?

April 9, 2023Europe says it's de-risking its relations with Beijing; Macron's China visit suggests otherwise. Meanwhile, Washington wants to build an anti-coercion coalition—but doing so demands a strong industrial base and there, trends aren't looking so hot. Plus, lithium is the new coal by one count, mineral M&A deals heat up, and the US still needs to refill the strategic petroleum reserve.

The Week That’s Done: China Battery Inc. Eyes the US

April 2, 2023Saudi Arabia and China strengthen their ties, and the world should pay attention. Plus, we dive into US efforts to bring allies under the Inflation Reduction Act umbrella – and China's efforts to crash the party (case in point: Chinese battery companies embedding themselves in the US automotive supply chain).

The Week That’s Done: Taiwan’s drought threatens semiconductor supply

March 26, 2023Is biotech the new semiconductor industry? Big Pharma hopes the answer is yes. Plus: Russia's path to become a Chinese “resource colony,” resurgence in offshore oil and gas, drought in Taiwan threatens semiconductor production, and what's actually up with China's domestic Covid vaccine?

The Week That’s Done: China’s industrial strategy

March 19, 2023We give you a blueprint of China's industrial strategy and will a Guinean iron ore mine help China slash dependence on Australian imports? Meanwhile, the EU unveils a critical minerals plan just as China tightens its grips on cobalt and lithium, Black Sea Grain deal uncertainty, and trade controls served two ways.

The Week That’s Done: Japan’s Green Hydrogen Bet

March 12, 2023Japan has recognized the strategic value of friendshoring since well before it became a buzz phrase—and a burgeoning Japan-Australia hydrogen partnership could offer lessons to other countries. Meanwhile, the US shale boom looks to be flagging, a new report raises aluminum alarms, and Europe’s China stance is hardening. Plus: Are we back to supply chain normality yet?

The Week That’s Done: The Smartphone Space Race

March 5, 2023The satellite space race is heating up—and China sees it as the next battlefield in the mobile communications contest. Plus: markets overreact to Tesla’s ex-rare earths announcement, Beijing's lithium crackdown, and Britain’s salad crisis. And banger factory activity in China contrasts with contraction in the US.

The Week That’s Done: The Rare Earth Conundrum

February 26, 2023Australian rare earth miner Lynas hits roadblocks in Malaysia, just as the red carpet is rolled out for its Chinese competitors. Meanwhile, battery giant CATL wants to lock in business with cut-rate prices—but only to select EV makers. Plus, natural gas prices tumble and a manufacturing slowdown in Japan.

The Week That’s Done: February 19

February 19, 2023Ford and CATL are teaming up to build a EV battery factory in the US, and it's a new lightning rod for the US-China competition. Europe's gas dilemma remains while the US reasserts itself as the global oil price maker. Plus, another week of a mixed bag of economic data, and US fund manager VanEck might be getting cold feet on China.

The Week That’s Done: February 12

February 12, 2023Fueled by Chinese demand, Brazil is on pace to tie the US as the world's largest corn exporter. Plus: A natural gas trading hub in Turkey could help Russia circumvent sanctions, China's opening threatens new inflationary pressures, and Pakistan wants a bail-out.

The Week That’s Done: February 5

February 5, 2023The EU goes head to head with the US on industrial policy, right when cooperation is most necessary. Plus, BP says that fossil fuels are out but US oil production surges and the world can't kick coal, China's pending export restrictions on solar and rare earth technology, and General Motors pushes ahead with investments in vertical integration. Plus: spy balloon.

The Week That’s Done: January 29

January 29, 2023Copper shortfall and a graphite black swan from China raises questions about future battery supply. Plus, Italy takes steps toward becoming a European energy hub, China's natural gas crunch explained, a multilateral move in chip restrictions on China, and the Maersk-MSC breakup could shake up global shipping.

The Week That’s Done: January 22

January 22, 2023Is US manufacturing in a recession? China’s re-opening puts new strain on commodity markets, Europe rushes to Russian diesel as the oil product import ban nears, and Bolivia picks China’s CATL to develop its lithium salt flats, while the UK’s Britishvolt battery startup collapses. Plus: Bad news for food production and a China-Indonesia wrinkle.

The Week That’s Done: January 15

January 15, 2023Wheat futures drop in their steepest weekly plunge since August, but risks remain – while the EU eyes more sanctions on Russian fuel, China eyes Australia’s lithium, and South Korea’s Q Cells eyes a new project in Georgia. Plus: A surprise rare earths find, US-EU tension, and a whole lot more.

The Week That’s Done: January 8

January 8, 2023With China moving on from COVID zero, the energy market looks to tighten – even more. Plus, US LNG exports ramp up, offshore wind energy hits headwinds, and manufacturing contracts, globally.

The Week That’s Done: January 1

January 1, 2023Happy new year – it’s still the same chaotic world: With COVID-19 ravaging China, testing controversy brews and Paxlovid becomes a luxury good. Plus the US job market holds on tight, Russia retaliates over the oil price cap, Japan snaps up global LNG supply, and plastics prices plummet.

The Week That’s Done: December 25

December 25, 2022Geopolitics goes back to basics: Zimbabwe bans lithium exports, the EU imposes a(n easily evaded) gas price cap, China and India snap up cheap Russian fuels, and the US moves forward on a strategic uranium reserve. Plus Myanmar and Russia coordinate on nuclear energy, the Bank of Japan shocks investors, and the US turns to Africa.

The Week That’s Done: December 18

December 18, 2022New strains hit Europe’s energy systems while the US fights to invest in next generation solutions, and struggles at the upstream. Plus, a breakthrough in nuclear fusion, hope that inflation might be easing (kind of), Japan’s new defense strategy, and more.

The Week That’s Done: December 11

December 11, 2022China pivots on Zero COVID as the G7 price cap on Russian oil exports goes into effect. And that’s just one example of a new move to values-aligned trade blocs. Plus: The upward trajectory of lithium battery and tin prices, Russian coal exports, and Germany’s efforts to diversify away from China.

The Week That’s Done: December 4

December 4, 2022Dampening inflation spurs enthusiasm, but where is the attention to contraction in the US manufacturing index? Plus: A roller coaster week for the growing US-EU trade spat, relaxation in China's COVID Zero restrictions, and a nascent EV industry shift to sodium-ion batteries.

The Week That’s Done: November 27

November 27, 2022There’s new progress in the ex-China rare earths supply chain, but is it enough? Plus: Energy turmoil as Europe’s bans on Russian oil and diesel loom; strikes threaten US, South Korean, and UK logistics; China’s back in lockdown; Taiwan has an election surprise; and the OECD summarizes things neatly with a gloomy outlook.

US Manufacturing PMI Data for November Shows Continued Contraction

November 25, 2022S&P Global PMI data, released November 23, showed continued contraction in the US manufacturing sector. The preliminary S&P Global US Manufacturing PMI fell to 47.6 from 50.4 in October, well below expectations of 50. This marks a 30-month low.

The Week That’s Done: November 20

November 20, 2022In the Indonesian new energy industry, the west risks financing China’s profit, and control. Plus, in factors: Enel builds a US solar panel plant; lithium stays hot; and the price cap on Russian oil nears. In markets: LNG prices resist demand, Japan’s economy shrinks, the UK does austerity – while stray missiles threaten to disrupt it all.

The Week That’s Done: November 13

November 13, 2022The EU’s ban on Russian petroleum products is a mere weeks away, winter looms, and the energy crisis is a global affair – with developing economies on the frontlines. Plus, deflation in China, competition in major metal exchanges, and the neon market heats up while palm oil cools.

The Week That’s Done: November 6

November 6, 2022Beijing completes its space station and we benchmark the US-China space race – while the Fed keeps hiking, Maersk adds to recession fears, the Black Sea grain deal falters, and Canada orders Chinese lithium companies to divest. Plus: an OPEC for battery minerals?

The Week That’s Done: October 30

October 30, 2022US critical mineral capacity remains critically inadequate, China buys up Indonesia’s cobalt, and what are the prospects for made in USA uranium? Plus, US GDP grows, but pain under the surface, tech players crumble, and manufacturing stalls.

US Manufacturing Stalls in October

October 26, 2022S&P Global PMI data, released October 24, showed a near-stalled US manufacturing sector. The preliminary S&P Global US Manufacturing PMI fell to 49.9 from 52 in September, well below expectations of 51.2. The decline in US manufacturing activity -- driven by inflation, a strengthening dollar, and earlier stockpiling -- is expected to accelerate.

The Week That’s Done: October 23

October 23, 2022Washington announces another SPR release – amid dropping US crude production, tightening Russia-China-Saudi Arabia oil nexus, and a new oil supply shock on the horizon. Plus, false flag in copper prices, Chinese infrastructure, a skittish yen, and food concerns.

The Week That’s Done: October 16

October 16, 2022The international market is increasingly bifurcated and in the West, the dominant theme is shortage: Aluminum crunch, refining crunch, wheat crunch, freight crunch, LNG crunch narrowly avoided – for now. Plus, in markets, inflation persists; debt risks brew among emerging economies; and Germany's trade surplus shrinks.

The Week That’s Done: October 9

October 9, 2022OPEC explicitly snubs Washington and the West, showing that productive beats consumptive power. Also not brilliant: US monetary tightening is cooling the economy, but in all the wrong places – and that ups recession risks. Plus: Maize malaise in Europe, the Mississippi’s dry spell, a US industrial policy stumble in lithium, and plunging global FX reserves.

The Week That’s Done: October 2

October 2, 2022Poll results show that the US public backs revoking China’s PNTR status and markets should take heed. Plus: Nord Stream sabotage, the LME considers banning Russian metals, Chinese battery and EV firms are snapping up global lithium supply, and the US needs to step up gas production.

The Week That’s Done: September 25

September 25, 2022Beijing plays both sides of today’s energy war, while expanding its influence over tomorrow’s markets. Meanwhile, European industry falters and the UK falters, generally; the Fed ups the ante but Beijing and Tokyo continue to sit this round out; and is copper the bargain of the moment?

The Week That’s Done: September 18

September 18, 2022Inflation is up and FedEx is down: US economic indicators have alarm bells ringing – while Latin America faces triple digit inflation and energy crisis pushes Europe to full-on intervention. Plus: Tesla walks the US-China tightrope; coal prices soar while oil production drops, and a decision point nears for metals markets.

The Week That’s Done: September 11

September 11, 2022A deep dive into Europe’s energy crisis shows faltering industry and political fault-lines, no end in sight for Moscow’s economic warfare, and Beijing as the real winner – plus Europe intent on doubling down on its own mistakes. In markets, a weak currency could strengthen China’s hand, elsewhere it’s hikes hikes hikes, and will India join a major global bond index?

The Week That’s Done: September 4

September 4, 2022Water crisis in Jackson hammers home the national infrastructure plight. Plus: The yen continues to slide and global bonds enter bear market territory; Pakistan and Sri Lanka secure IMF loans while Russia wreaks energy market havoc (price cap be damned); new battery plants and chip export restrictions in the US suggest industrial policy at work – but is it working?

The Week That’s Done: August 28

August 28, 2022Moscow toys with global energy markets and LNG prices surge – with second-order consequences for Beijing’s international influence, global food supply, US inflation. Plus: Drought compounds agricultural crisis, the SPR sits at its lowest level since 1985, Japan eyes nuclear, and China launches a new wave of stimulus. And, of course, Powell says tighten your seatbelts.

The Week That’s Done: August 21

August 21, 2022Record temperature shut down China and squeeze Europe - not the heat the global economy needs. Plus the Chinese central bank cuts rates while UK inflation hits 10.1%, copper miners stay optimistic and the IRA gives them reason, and nuclear fears in Ukraine. Happy weekend!

The Week That’s Done: August 14

August 14, 2022The CHIPS Act is a carrot and Manchin's EV sourcing requirements a stick: US industrial competition could be ready for a comeback - if the private sector is on board. Plus: The energy scramble continues while Turkey plays metals middleman; US inflation relaxes, but so does productivity; and China flexes its delisting muscles

The Week That’s Done: August 7

August 7, 2022Across wheat, gas, steel, the shortage crisis has calmed - but (largely) because of dropping demand, not rising supply. With manufacturing slumping, future food production threatened, buffer eroded, what happens next? Plus: Storm clouds gather in the UK and China throws a temper tantrum.

The Week That’s Done: July 31

July 31, 2022Rare movement in DC offers a glimmer of hope for industrial investment – or at least a signal to the private sector. The bad news: This challenge is above government's pay grade; recession (word choice be damned) looms, and not just in the US; everywhere from energy to grain to space, Russia is adeptly playing spoiler. Plus: scandium, tritium, fixed-price forward contracts, and more.

The Week That’s Done: July 24

July 24, 2022The EU's twin energy and economic crises threaten the bloc's cohesion, also political losses on those struggling to hold it together. Plus: Inflationary pressures mean no tariffs on Russian fertilizer, dumping be damned; the EV revolution strengthens China's auto hand; monkeypox is a global health emergency; and more fun fun fun.

The Week That’s Done: July 17

July 17, 2022Inflation hits a whopping 9.1, but if anything the supply picture is getting worse: Peloton gives up on production, Intel stalls in Ohio, the Texas grid sputters, and Biden strikes out with MBS. Plus: Europe might be headed for shut off, China is gobbling up lithium, and there’s political chaos on the horizon.

The Week That’s Done: July 10

July 10, 2022From disruption in personality politics to cascading social (and economic) disruption, this week has it all. Plus, natural gas soars even if oil shows relief; China doubles down on lithium; dollar-euro parity nears; and the US continues to waffle on tariffs.

The Week That’s Done: July 3

July 3, 2022The good news: It's a long weekend. The bad: California can't figure out supply and demand, US manufacturing is slowing, and the G7's price cap scheme doesn't mean much. Plus: Things look even worse in Europe, copper's drop might just be a blip, will the chemical industry move to China?

The Week That’s Done: June 26

June 26, 2022With the energy crisis here to stay, the White House is throwing Econ 100 to the winds; Europe on a quest for new supply; and China sitting pretty atop cheap Russian imports that promise new energy influence, and leverage over the West. Meanwhile we round out the week with economic collapse in Sri Lanka, a COVID pill in China, and a looming critical mineral shortage.

The Week That’s Done: June 19

June 20, 2022Washington brings supply-side tools to a demand-side fight; the EU fares no better. Meanwhile Moscow turns off gas to Europe while Beijing continues to snipe chip tech. Plus: All eyes on Xinjiang, the Yen, and the WTO's pyrrhic victory.

The Week That’s Done: June 12

June 12, 2022Gas prices hit all-time highs as inflation gallops ahead; Washington relaxes solar tariffs while playing softball with Russia's plunder; plus China stocks make (minor) gains, BYD makes bigger gains, and TSX launches a battery metals index

The Week That’s Done: June 5

June 5, 2022The EU promises that it will block most Russian oil imports maybe – all while production continues to stall and Australia offers worrying indicators of shortage ahead; plus we have European inflation, car companies as space companies, and a pyrrhic victory for the US.

Factors and Markets Briefing: Week of May 23

May 29, 2022With record gas prices, squeezed agricultural producers, and stubborn labor crisis, the era of shortage is here to stay -- and likely worsen. Cue shifting consumer habits, Sri Lanka's default, and a move toward industrial integration (anti-trust be damned). Happy Memorial Day!

Markets Briefing: Week of May 16

May 22, 2022US stocks hit their longest losing streak since the Great Depression – while continuing lockdowns in China, energy dilemmas in Europe, and a continuing failure to invest in domestic production suggest that a reversal of fortune is not on the horizon

Markets Briefing: Week of May 9

May 15, 2022Against a backdrop of staggering inflation, it's general chaos: Crypto crashes, alongside the stock market; dependence on China freezes the US solar industry; the Hong Kong dollar's peg to the USD faces a squeeze; and somehow we're in a perfect storm of inflation, capital market collapse, and great power competition.

Markets Briefing: Week of May 2

May 7, 2022As inflation soars, the Fed tightens the screws – and markets balk; the real economy weathers the storm better than most; both government and private sector double down on EV supply chains.

Markets Briefing: Week of April 25

April 30, 2022Ping'an advises HSBC to split into an east and west operation -- which sounds like decoupling but could be the opposite; commodities markets wrestle with a liquidity squeeze; the EU steps up (kind of) for Lithuania amid trade dispute with China, and China continues to find loopholes in US trade regulations

Markets Briefing: Week of April 18

April 23, 2022With recession alarms blaring, supply-side solutions remain elusive; the world writes off streaming even as Netflix's revenue grows; Chinese companies target European listings; and the Dutch bet big on photonics while the US-South Korea battery alliance hits rocky waters.

Markets Briefing: Week of April 11

April 16, 2022China's CNOOC grows wary of the US, but not of a global footprint; GM and Glencore announce a flashy new supply partnership; and Beijing signals that there's more intervention in capital markets ahead.

Markets Briefing: Week of April 4

April 8, 2022Canada wakes up -- kind of, and slowly -- to the risks of foreign investment in strategic areas; elsewhere, it's EVs, EVs, and EVs, but without commensurate attention to the upstream

Markets Briefing: Week of March 28

April 2, 2022The EU makes a long-shot bid for gas market leverage; the Commerce Department wises up to China's solar tariff circumvention; and China's Securities Regulatory Commission looks to cozy up to the SEC