a/symmetric: Decoding China’s industrial system

August 24, 2024On big picture context and frameworks, and finding signals from noise

a/symmetric: Tallying China’s innovation

August 17, 2024Beijing wants to direct money towards the most innovative firms

a/symmetric: China’s Starlink bets

August 10, 2024China launched the first satellites of its megaconstellation. The effort is aimed at a grand prize: 6G leadership

a/symmetric: Don’t forget the low-tech manufacturing

August 3, 2024High-tech dreams stand on low-tech beams. Or, industrial foundations matter.

a/symmetric: Dawn of the supercomputing internet

July 12, 2024China aims to leverage networks, not just computers, to win the supercomputer race

a/symmetric: Measuring the resilience of AI industrial chains

July 8, 2024Import dependence is only one measure of countries’ relative strengths and weaknesses in AI.

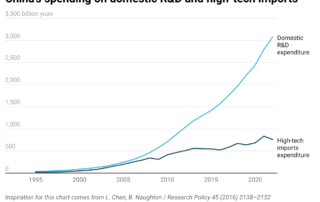

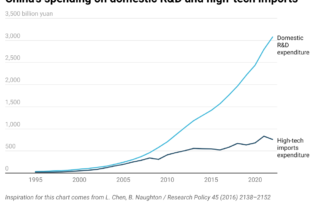

a/symmetric: China’s quest to replace foreign tech

June 22, 2024Its import substitution efforts gain steam, helped by both increased R&D spending and "poor man's innovation."

a/symmetric: China-Australia rare earth intrigue

June 6, 2024Digging into a Chinese investor with state ties

a/symmetric: The industrial basics of critical tech

May 25, 2024Why it’s important to control “the thing to make the thing to make the thing to make the thing”

a/symmetric: China’s second mover advantage?

May 18, 2024Reactions to GPT-4o, and other observations on the AI race

a/symmetric: How China innovates

May 11, 2024It prioritizes industrializing technology, transforming scale into market power.

a/symmetric: Missing the swarm for the drones

May 5, 2024Washington risks repeating its Huawei mistakes with DJI

a/symmetric: China bets on industrial AI

April 27, 2024Doing so sidesteps its US tech dependence and amplifies its manufacturing might

a/symmetric: Germany: China’s useful idiot?

April 20, 2024Chancellor Olaf Scholz wants to thread a fine needle on China. But the asymmetries in Sino-German ties, strategies, and priorities make that a tall challenge.

a/symmetric: Huawei’s sanctions-beating strategy

April 6, 2024Washington boasted that it had “dealt a direct blow” to the firm. Instead, Huawei parried America’s punches and just reported its biggest-ever jump in profits. How’d it do it?

a/symmetric: “Buy China” vs. “Buy America”

March 31, 2024Beijing has long used policies to favor domestic firms and disadvantage foreign ones

a/symmetric: Nvidia wants ‘AI factories.’ China is building lots of them.

March 23, 2024Leverage over computing infrastructure could shape the global AI contest

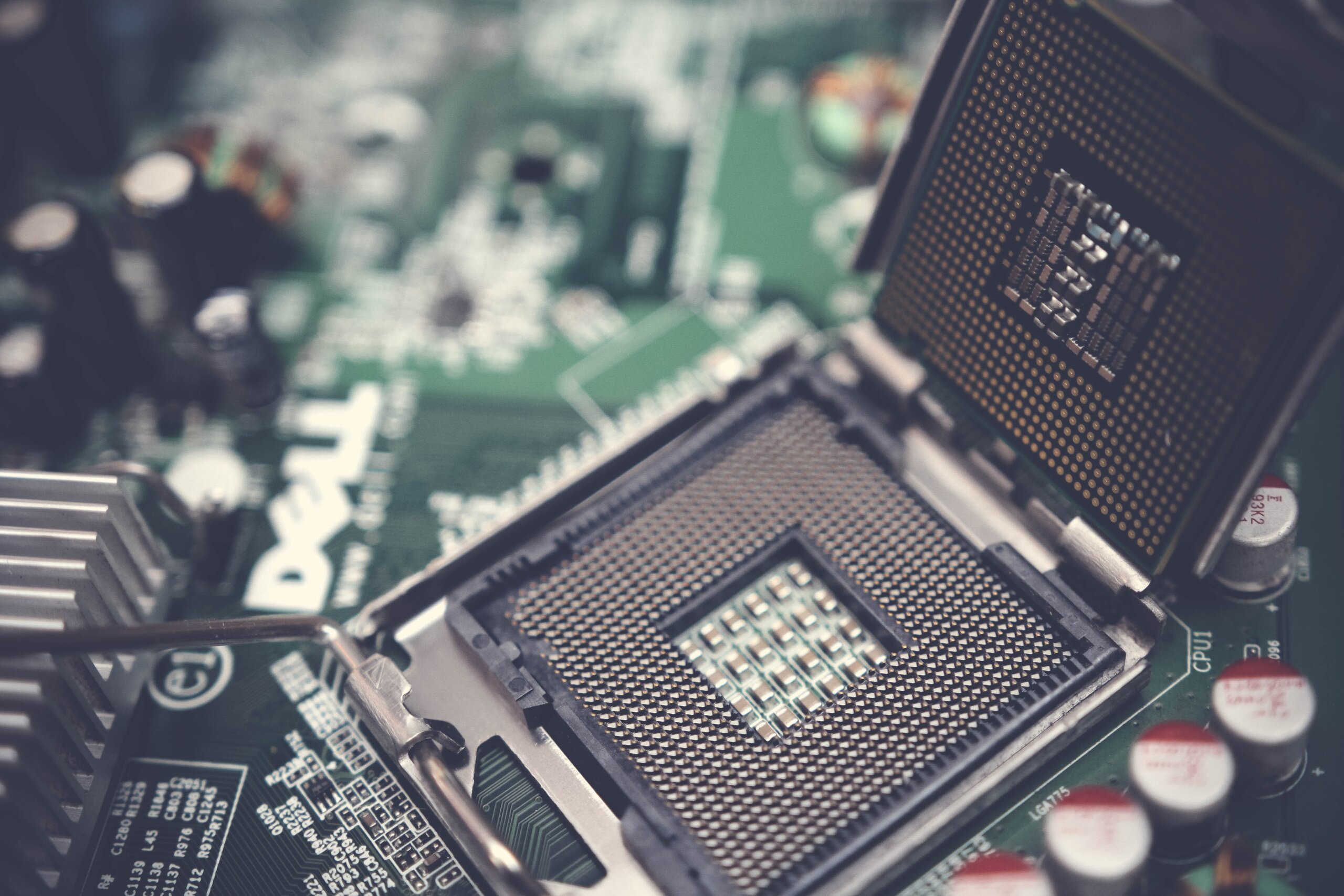

a/symmetric: An air-con maker turns to next-gen chips

March 16, 2024Gree’s new SiC wafer plant underlines the importance of compound semiconductors in China’s chip strategy.

a/symmetric: How Apple boosted China’s manufacturing base

March 9, 2024The iPhone maker has long relied on Chinese suppliers, in turn helping them upgrade their technological capabilities. Now those suppliers are helping domestic brands like Huawei and Xiaomi chip away at Apple’s market share.

a/symmetric: China is exporting its entire EV industrial chain

March 1, 2024Car exports are a function of a larger strategic goal: “whole industrial chain output," which can in turn be leveraged to win influence over technology standards, trade flows, business models, and global commerce writ large.

a/symmetric: How China’s crane champions conquer global markets

February 24, 2024Will Beijing run laps around Washington's attempts to root out China-built cargo cranes from US ports? Without a full view of major Chinese crane manufacturers, their competitive positions, and and how Beijing supports them to corner markets worldwide, that stands to be a real risk.

a/symmetric: What critical technologies lists can and can’t tell us

February 17, 2024Critical technologies lists only tell part of the story. They don’t reflect the full scope of the global industrial competition, including low(er)-tech know-how, upstream inputs, market applications that bring sales and profits.

a/symmetric: European solar, eclipsed?

February 10, 2024The fate of Europe’s solar industry has implications for the EU industrial base—and its economic security

a/symmetric: Huawei & DJI eye the autonomous driving throne

February 3, 2024The two companies are leveraging vertical integration to compound existing strengths and gain new competitive advantages. Plus: export controls whac-a-mole, Huawei goes to space, and the industrial base of high tech contests

a/symmetric: Why China still can’t make ballpoint pens

January 26, 2024And what that means for its high-end machine tools ambitions

a/symmetric: The “latest front” in the US-China competition?

January 20, 2024The global industrial contest is being waged between supply chains, not discrete technologies.

a/symmetric: “Deplorable dependence”—and an industrial base to fix it

January 14, 2024On the heels of the Pentagon's publication of its first ever National Defense Industrial Strategy, a look at a prescient 1920 analysis by a US Naval officer that lessons for today's efforts to fortify the US defense industrial base

a/symmetric: De-risking with Chinese characteristics

January 6, 2024How China has long deployed an asymmetric industrial strategy that it now purports to denounce

a/symmetric: China’s game plan for the AI race

December 29, 2023Looking beyond chatbots to take stock of China’s AI ambitions and strategy

a/symmetric: China’s global rare earths shopping spree

December 22, 2023Shenghe Resources snaps up strategic assets in Canada and Tanzania, and gains still more leverage over global rare earth supply chains.

a/symmetric: Ammo, chips, and military upstream inputs

December 16, 2023Production capacity even in relatively lagging-edge technologies can confer outsize strategic advantages—or costs.

a/symmetric: IBM’s new quantum chip, China’s quantum ambitions

December 9, 2023A look at the global race to develop quantum technology, and how China is adopting an asymmetric strategy in pursuit of quantum dominance

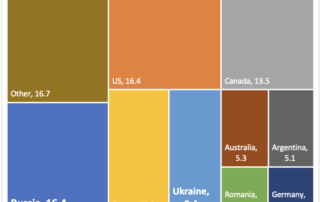

The Week That’s Done: Weathering Europe’s energy crisis, Russia refuses rupees

December 2, 2023Europe weathered the acute shocks of the energy crisis, but more risks lurk. Meanwhile, markets aren't convinced by the OPEC cuts, Middle Eastern funds are flocking to Hong Kong, and Russia doesn’t want to take oil payments in rupees. Plus: bots in oil trading.

Deglobalization Round-Up: December 2, 2023

December 2, 2023Burner phones for Hong Kong trips, PCAOB fines for PwC China and Hong Kong, quant hedge funds eye opportunities in China, and Indian biotech firms benefit from the de-risking push.

The Week That’s Done: The logistics of critical minerals, ship hijack threatens supply chains

November 25, 2023The business of moving critical minerals around the world can be as important as digging them out of the ground—and Chinese logistics firms are making investments in ports and roads around key mines. Meanwhile, Petrobras’s ambitions, Indonesia’s dream minerals deal and Europe’s stress signals. Plus: a Red Sea hijacking could disrupt Asia supply chains.

Deglobalization Round-Up: November 24, 2023

November 24, 2023A US asset manager sees opportunity in China—even as over three-quarters of the foreign money invested in Chinese stocks this year has left. Meanwhile, China ships out small amounts of gallium and germanium, the EU signs its anti-coercion tool into law, and the FT’s Ruchir Sharma argues that it’s a “post-China world now.”

Deglobalization Round-Up: November 18, 2023

November 18, 2023Singapore mulls stricter investment rule, Australia proposes easing defense export controls to the UK and US, Washington and Beijing strike a fentanyl deal, and Alibaba scraps its cloud unit spinoff plans. Plus: Applie Materials under investigation.

Deglobalization Round-Up: November 11, 2023

November 11, 2023Gallup quits China. More executives disappear in China. Morgan Stanley’s CEO says decoupling is a temporary trend. Plus: does the US need to be more like Korea, Germany, and Japan in order to become an advanced manufacturing powerhouse?

The Week That’s Done: Hidden exposure to China, cyberattack hits Aussie ports

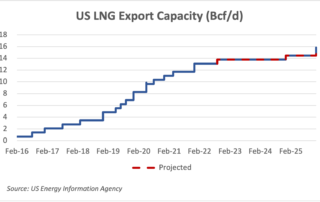

November 11, 2023Measuring US supply chains’ exposure to China—and why a secure industrial strategy requires investments in both upstream and downstream nodes. Meanwhile, US LNG dominance rises, China’s imports of semiconductor making equipment from the Netherlands soars, and Australia shuts four key ports following a cyber breach.

The Week That’s Done: Mining’s financing problem, China’s triple plunge

November 4, 2023If the West wants to reduce reliance on China for minerals, it will need to invest some serious money into big mining projects—but so far, investors seem reticent. Meanwhile, risks may be lurking in the tin supply chain, Chinese EVs could threaten European aluminum, and China sees plunging IPOs, inbound FDI, and manufacturing PMI.

Deglobalization Round-Up: November 4, 2023

November 4, 2023China plays good cop, bad cop on US semiconductor company Micron. Vanguard quits China. US senators oppose a limited free trade agreement with Indonesia. And CCP officials are banned from private equity investments.

The Week That’s Done: The Stellantis-Leapmotor deal

October 28, 2023Jeep-maker Stellantis shells out for a stake in Chinese EV maker Leapmotor—and what could possibly go wrong? Meanwhile, a mega oil merger, Europe’s battery champion Northvolt eyes a mega IPO, and Russia and China eye ever closer relations. Plus: tensions flare in the South China Sea.

Deglobalization Round-Up: October 28

October 28, 2023EV and battery makers ponder implications of China’s graphite export restrictions. Brazilian planemaker Embraer plans to expand in China as ties between Brasilia and Beijing deepen. And Sino-Russia ties are getting ever warmer, with a raft of business deals inked this week.

The Week That’s Done: Persistent loopholes in US chip curbs

October 21, 2023Major semiconductor companies largely brush off Washington’s updated export restrictions. Russia wants to sell more gas to China, but Beijing plays hard to get. A major lithium takeover deal [...]

Deglobalization Round-Up: October 21

October 20, 2023Corporate investigations and intelligence firms decide Hong Kong isn’t worth the risk. Across the border, a Japanese businessman is formally arrested by Chinese authorities. Meanwhile, India gets uncomfortable with yuan-denominated payments for oil—though France doesn’t too concerned with using the Chinese currency for LNG trade. Plus: the UK’s MI5 warns of Chinese espionage on an “epic scale.”

The Week That’s Done: HongShan (née Sequoia China) eyes global investments

October 14, 2023Sequoia’s China spin-off is searching for investment targets worldwide, underlining private capital flows as an arena of geopolitical competition. Meanwhile, a fertilizer shock could raise global food prices, Japan deals with an inflation and deflation dilemma, BYD spots another IRA backdoor, and US inflation rears its stubborn head. Plus: oil and gas volatility.

Deglobalization Round-Up: October 14

October 14, 2023Saudi-China AI collaboration could throttle the kingdom’s access to US chips, Europe plans a probe into Chinese steelmaker subsidies, Beijing restricts offshore trading by domestic brokerages, and British banks game out their China risks. Plus: Chinese EV suppliers find IRA back doors in Morocco and South Korea.

The Week That’s Done: Alibaba’s logistics and industrial internet strategy

October 7, 2023A closer look at Alibaba logistics arm Cainiao’s prospectus—and its strategy for the industrial internet. Meanwhile, LNG developments abound: US exports surge, Asia wants to diversify its portfolio, and the Middle East has big natural gas ambitions. Plus: the state of global manufacturing, and rising rice risks.

The Week That’s Done: A US rare earth magnet factory’s China ties

September 23, 2023The Pentagon is funding a major domestic rare earth magnet factory–but beware hidden risks of its China exposure. Meanwhile, diesel prices surge, uranium may be entering a bull market, and Australia’s national manufacturing fund places its first bets. Plus: a Saudi-Israeli-American uranium deal.

Deglobalization Round-Up: September 22

September 22, 2023Saudi Arabia and Turkey are both angling for a Tesla factory. Foxconn wants to expand on its manufacturing operations in India. The EU is worried about dependence on Chinese batteries. And Wester profits are trapped in Russia.

The Week That’s Done: Europe battles the Chinese EV deluge

September 16, 2023Can EU tariffs blunt the threat of China’s EV dominance? Unlikely. Meanwhile, Russia sells pipeline gas to China for cheap, the US and Saudi Arabia mull a minerals partnership, gasoline prices drive US inflation, and China’s urea export curbs threatens more food inflation. Plus: US auto workers strike.

Deglobalization Round-Up: September 15

September 15, 2023SK Hynix in geopolitical crosshairs, Japanese medical equipment makers feel the pressure too move manufacturing to China, Tokyo tries to devise a strategy to combat economic coercion, and a US Congressional delegation hawkish on China got a “sometimes-cool” reception on Wall Street.

The Week That’s Done: Asymmetric competition, symmetric benchmarks

September 9, 2023Is GDP growth a good measure of the US-China competitive balance? Meanwhile, oil climbs, firms scramble for a copper mine in Botswana, and investments pick up in integrated photonics. Plus: US military ambitions for an expanded AI fleet—and questions about the national industrial base needed for the build out.

Deglobalization Round-Up: September 9

September 9, 2023China is set to launch a new state-backed semiconductor investment fund. Beijing bans central government officials from using iPhones at work, causing Apple shares to plummet. Corporate America still can’t quit China. And the return of just-in-time manufacturing?

The Week That’s Done: Global minerals grab, LNG turbulence

September 2, 2023China has bought half of the world’s biggest lithium assets put on the market since 2018, far more in value than Australia and the US combined. Meanwhile, extreme weather heightens LNG volatility, Huawei’s semiconductor teaser, and Germany’s economic struggles. Plus: energy market impacts from the coup in Gabon.

Deglobalization Round-Up: September 1

September 1, 2023Vietnam and India emerge as major components of Apple’s supply chain. An engineer shortage could hamper Vietnam’s chip ambitions. Nvidia and AMD face new US export restrictions to some Middle Eastern countries. Plus: global logistics groups ramp up Asia investments.

The Week That’s Done: China’s economic pain, dollar’s durable dominance

August 26, 2023Can China rejig its economic model to tap new growth—and does it need double-digit GDP expansion to wage asymmetrical industrial competition? Meanwhile, watch out for shifts in global LNG flows and trading, the rise of Vietnam as a rare earths magnet hub, and Germany’s bid to tighten foreign investment controls. Plus: what de-dollarization?

Deglobalization Round-Up: August 25

August 25, 2023Overseas investors flee the Chinese market, Arm’s prospectus spotlights its risky China relationship, Huawei is building a shadow chipmaking network, Russia extorts foreign firms some more, and a US-China science pact gets a six-month extension.

The Week That’s Done: China’s battery glut, US steelmaking

August 19, 2023A slowing Chinese economy could worsen its battery overcapacity problem and derail battery projects abroad. Meanwhile, Russia steps up its grains war, consolidation looms for US steelmaking, and Japan’s GDP booms. Plus: Texas grid troubles.

Deglobalization Round-Up: August 18

August 18, 2023US imports of EV batteries and components are scrutinized for forced labor links, Canada investigates Ralph Lauren’s alleged exposure to Uyghur forced labor, and state-owned Chinese companies are told to drop foreign law firms. Plus: reclaiming land for food security?

The Week That’s Done: outbound investment screening, industrial policy

August 13, 2023Call it industrial policy, state intervention, or marketcrafting: governments have realized that market forces alone won't address economic security and supply chain risks. Meanwhile, LNG volatility spikes, offshore wind investments slump, and the White House targets investment in Chinese tech. Plus: global food turmoil.

Deglobalization Round-Up: August 11

August 11, 2023Global law firm Dentons splits off its China unit, Russia freezes Goldman Sachs's assets, and supply chain costs are dropping—but they likely won't return to pre-Covid, pre-war levels. Plus: TSMC will build factory in Germany.

The Week That’s Done: US industrial base, chip sanctions loopholes

August 5, 2023Is US manufacturing booming or slowing down? The factory output index is on a contractionary streak, even as industrial companies give rosy outlooks. Meanwhile, oil giant Exxon wants to supply lithium, a rare earths processing partnership collapses, and Italy regrets joining Beijing’s Belt and Road.

Deglobalization Round-Up: August 5

August 5, 2023The Hong Kong bourse rolls back requirements for disclosing China-related risks, a US Congressional committee investigate Blackrock and MSCI’s routing of American capital to problematic Chinese entities, Maersk forecasts a deep contraction in global trade, and Rome plans to set up a “Made in Italy” fund.

The Week That’s Done: Huawei’s comeback, Volkswagen’s gamble

July 28, 2023Huawei will reportedly mass produce in-house designed 5G chips by the end of this year, highlighting the tech giant’s—and the broader Chinese industrial ecosystem’s— resilience against US sanctions. Meanwhile, [...]

Deglobalization Round-Up: July 28

July 28, 2023Beijing wants its law firms to downplay China-related business risks. Volkswagen and Xpeng’s bombshell partnership, and the Nissan-Renault alliance gets a reboot to compete with China. Plus: China realigns its outbound foreign direct investments.

The Week That’s Done: Climate competition, manufacturing FDI

July 23, 2023Can climate cooperation reset US-China relations? Probably not. Meanwhile, the US works to onshore a graphite supply chain, Russia threatens global food supplies, the UK gets a second gigafactory (with a dose of China dependence).

Deglobalization Round-Up: July 21

July 21, 2023HP is shifting production away from China, while AMD wants to rely less on TSMC. Meanwhile, Moscow seizes the assets of Danone and Carlsberg, a US Congress panel examines US VC deals with China, and lawmakers scrutinize the Ford-CATL tie-up. Plus, the rise and fall of Globocorp.

The Week That’s Done: Critical minerals midstream risks, Germany’s China strategy

July 14, 2023Global investments in critical minerals are booming, but the midstream processing segment is still dominated by China—which in turn is diversifying its upstream supplies and intensifying competition over mining assets worldwide. Meanwhile, Europe’s industrial natural gas use falls, China muscles into LNG re-exports, and Germany unveils its new China strategy.

Deglobalization Round-Up: July 14

July 14, 2023Following a raid on Bain's Shanghai offices in March, Chinese authorities are now appearing to take a friendlier approach, paying the consulting firm a courtesy call this month. Meanwhile, Ron DeSantis says he would support revoking China's trade status, global investors cool on China's reopening play, and the tables have turned for foreign carmakers in China.

The Week That’s Done: China flexes its upstream muscles

July 8, 2023Gallium and germanium stole the headlines this week. The even bigger headline: China’s asymmetric play underlines the importance of investing in upstream resources. Meanwhile, Europe dubs aluminum a critical raw material, Moderna takes a chance of the China market, and Toyota claims a battery breakthrough.

Deglobalization Round-Up: July 8

July 8, 2023Chinese state media rebukes Goldman Sachs, US inspectors check in on Chinese firms' Hong Kong audits, and the Japanese manufacturer Nidec Corp. builds a new cutting-tools factory in India. Plus, China sounds an upstream warning with germanium and gallium export curbs.

The Week That’s Done: China puts US companies on notice

July 2, 2023Beijing’s new laws increase the already high risks for foreign firms doing business in China—so will companies take the hint? Meanwhile, a US air conditioning startup partners with a Chinese battery giant, raising questions about potential commercial and potential risks.

The Week That’s Done: EU economic security, US EVs head to China

June 27, 2023Europe tries a difficult economic security balancing act—while simultaneously deepening ties with China in strategic sectors. Meanwhile, CATL goes upstream into lithium, Middle Eastern state firms go downstream into EVs, and foreign carmakers head to China. Plus: can spin-offs brush off geopolitical risk?

The Week That’s Done: China’s stimulus, Toyota’s pivot

June 18, 2023China turns on the stimulus spigot, the US takes a pause, Europe hikes, and Japan stays as dovish as ever. Meanwhile, oil demand is sticky and it’s boom time for LNG. Plus, Toyota’s strategic pivot and France’s push for tariffs on Chinese EVs.

Deglobalization Round-Up: June 17

June 17, 2023US capital stops flowing to China, Volkswagen builds an EV plant in Canada, and Italy investigates Chinese government access to TikTok. Plus Bunzl's de-risking and restrictions on AI platforms in China.

The Week That’s Done: Chinese takeovers, Sequoia splits

June 11, 2023Italy is reckoning with Chinese corporate influence — but damage can be hard to undo, and interventions now can prove too little too late. Just ask Pirelli. Meanwhile, Saudi Arabia’s production cut sweetens business for some and slashes profits for others, Sequoia splits three ways, and China flirts with deflation. Plus: more West Coast port uncertainty.

Deglobalization Round-Up: Saturday June 10

June 10, 2023Sequoia splits up its US and China operations, Microsoft moves AI researchers from China, and Pirelli's CEO warns that Sinochem's investment threatens the company's integrity. Plus, New Balance expands its US manufacturing footprint.

The Week That’s Done: Beijing woos CEOs, snubs US defense chief

June 4, 2023China gives global CEOs a warm welcome, but the US defense secretary the cold shoulder. At the same tie, follow the money: Global investors are cooling on China. Plus: Saudi Arabia and Russia, Japan and wind, cathodes and anodes.

Deglobalization Round-Up: June 3

June 3, 2023Investors scale back investments in Chinese State-owned enterprises as Canadian pension funds scale back investments in China. Plus Grey Duck Outdoor's reshoring plan, Japan's ex-China rise, and China's aerial aggression.

The Week That’s Done: China bans Micron

May 28, 2023Big Oil is here to stay, for now—but it’s hedging its bets with investments in Big Shovel, while Big Auto wants minerals in spades. Meanwhile, Asia gobbles up Russian fuels, China bans Micron as Nvidia soars, and the US economy faces tough choices. Plus: How a drying Panama Canal could derail global LNG markets.

Deglobalization Round-Up: May 27

May 27, 2023China bans Micron, rebukes the ambassador of Japan, and attacks critical infrastructure in the US and Japan. Plus: SIlicon Valley distances itself from China, Apple tilts toward India, and a spike in US reshoring jobs.

The Week That’s Done: China’s Full-Stack EV Strategy

May 21, 2023Chinese automakers are making moves to dominate downstream auto services — with implications for national and industrial security. Meanwhile, the G7 celebrates the success of its Russian oil price cap, a looming oil deficit, and a wave of consolidation in energy and mining markets. Plus: more firms are betting on national security as a guiding investment thesis.

Deglobalization Round-Up: May 20

May 20, 2023Senator Coons sees new opportunity for reshoring and Levi Strauss sees value in nearshoring. Plus: G-7 derisking communiqué, Wall Street's growing concerns about China, and The Economist asks, “is Chinese power about to peak?”

The Week That’s Done: A Mega Lithium Merger

May 14, 2023It’s not every week that the largest ever lithium deal gets inked–and more consolidation could be on the horizon. Meanwhile, Argentina wants to be a copper major, Australia wants to ride the hydrogen commodity boom, and Canada is struggling to monitor mining investments. Plus: A look at Rockwell Automation’s China footprint.

Deglobalization Round Up: May 12

May 12, 2023Reshoring solar panel manufacturing would speed decarbonization. Plus British Columbia's public pension manager exits China, US tech investors do too, and (three makes a trend) Italy intends to exit the Belt and Road Initiative.

The Week That’s Done: China’s Midea eyes Sweden’s Electrolux

May 7, 2023A Chinese home appliance giant wants to acquire a Swedish home appliance brand—and it’s not as mundane as it seems. Meanwhile, China goes big on oil drilling, positions to leapfrog on EVs, and cements (steels?) its partnership with Riyadh. Plus: Rate hikes, another Goldilocks jobs report, and EV makers’ direct sourcing ambitions.

Deglobalization Round-Up: May 6

May 6, 2023SK Hynix, Taiwanese suppliers, FedEx, and foreign investors are all souring on China. Plus Beijing's cross-border data crackdown, the Senate votes not to remove tariffs on solar materials imported from Southeast Asia, and Canada's new forced labor law.

The Week That’s Done: Updating America’s Industrial Strategy

April 30, 2023Washington and its allies are questioning the orthodoxy of globalization. Meanwhile, Russia ropes Turkey into its nuclear orbit, China continues its attack on foreign businesses, and the global aluminum market hinges on rains in Yunnan. Plus: Risk of a Marburg epidemic and improving global health security with small vaccine stockpiles.

Deglobalization Round-Up: April 29

April 29, 2023Lego launches its first US manufacturing facility, Germany considers limiting export to China of chemicals used to produce semiconductors, and Aidan Madigan-Curtis of Eclipse Ventures argues that new technologies will fundamentally shift the landscape for American production.

The Week That’s Done: Chile wants to nationalize lithium

April 23, 2023Is the West buying laundered Russian oil? Plus: Caveats to China's GDP rebound, copper supplies are tightening, Chile wants to nationalize lithium, hurdles for US LNG projects, and CXMT's IPO.

Deglobalization Round-Up: April 19

April 19, 2023CEOs embrace reshoring, Dell and Apple want to diversify away from China, and investors are pulling out of China. Plus: China's surgical retaliation against Western companies, Christine Lagarde's fragmentation warning, and is India the answer?

The Week That’s Done: Mega sites for mega factories

April 16, 2023US manufacturing is booming—but companies need factory space. Meanwhile, Tesla doubles down on China, Indonesia wants to join the US EV tax credit party, and a wheat blast disease pandemic could threaten global food security.

Deglobalization Round-Up: April 12

April 12, 2023Apple's pivot to India picks up steam as concerns grow about the Ford-CATL facility in Michigan, the role of international companies in fueling China's aerospace apparatus, and sanctions risk in a deglobalized environment. Plus: Vanguard leaves China and Macron's Xi Jinping "love-fest."

The Week That’s Done: Can Europe de-risk its China ties?

April 9, 2023Europe says it's de-risking its relations with Beijing; Macron's China visit suggests otherwise. Meanwhile, Washington wants to build an anti-coercion coalition—but doing so demands a strong industrial base and there, trends aren't looking so hot. Plus, lithium is the new coal by one count, mineral M&A deals heat up, and the US still needs to refill the strategic petroleum reserve.

Deglobalization Round-Up: April 5

April 5, 2023Jamie Dimon sours on China, China retaliates against US export controls, and LG increases its investment in Arizona. Plus corporate America is talking deglobalization and emerging economies from Poland to Mexico will benefit.

The Week That’s Done: China Battery Inc. Eyes the US

April 2, 2023Saudi Arabia and China strengthen their ties, and the world should pay attention. Plus, we dive into US efforts to bring allies under the Inflation Reduction Act umbrella – and China's efforts to crash the party (case in point: Chinese battery companies embedding themselves in the US automotive supply chain).

The Week That’s Done: Taiwan’s drought threatens semiconductor supply

March 26, 2023Is biotech the new semiconductor industry? Big Pharma hopes the answer is yes. Plus: Russia's path to become a Chinese “resource colony,” resurgence in offshore oil and gas, drought in Taiwan threatens semiconductor production, and what's actually up with China's domestic Covid vaccine?

Deglobalization Round-Up: March 25

March 25, 2023US reshoring job numbers hit record high, Chinese authorities raid Mintz's office, TikTok CEO has a tough day in Congress, and Sweden shifts away from its full embrace of free trade with draft foreign investment review regulations.

The Week That’s Done: China’s industrial strategy

March 19, 2023We give you a blueprint of China's industrial strategy and will a Guinean iron ore mine help China slash dependence on Australian imports? Meanwhile, the EU unveils a critical minerals plan just as China tightens its grips on cobalt and lithium, Black Sea Grain deal uncertainty, and trade controls served two ways.

Deglobalization Round-up: March 18

March 18, 2023Vanguard ditches China, and so do software developers. Plus: A potential TikTok ban, the EU moves to restrict investments in overseas production facilities, and a new paper points to the benefits of reshoring API Production.

The Week That’s Done: Japan’s Green Hydrogen Bet

March 12, 2023Japan has recognized the strategic value of friendshoring since well before it became a buzz phrase—and a burgeoning Japan-Australia hydrogen partnership could offer lessons to other countries. Meanwhile, the US shale boom looks to be flagging, a new report raises aluminum alarms, and Europe’s China stance is hardening. Plus: Are we back to supply chain normality yet?

Deglobalization Round-Up: March 11

March 11, 2023Canada moves to review mineral investments, Germany to review telecommunications networks, and the US to review technologies emanating from adversary countries. Plus US companies are rethinking Chinese supply chains, reshoring solar energy production promises to accelerate decarbonization, and Silicon Valley Bank's China tie.

The Week That’s Done: The Smartphone Space Race

March 5, 2023The satellite space race is heating up—and China sees it as the next battlefield in the mobile communications contest. Plus: markets overreact to Tesla’s ex-rare earths announcement, Beijing's lithium crackdown, and Britain’s salad crisis. And banger factory activity in China contrasts with contraction in the US.

Deglobalization Round-Up: March 4

March 4, 2023General Electric invests in the US as Apple's China suppliers seek international bases, the US solar industry tries to wean itself off China, and HSBC admits that its support for Beijing has threatened human rights. Plus, Putin and Biden shore up their respective, conflicting alliances against a backdrop of global trade, Beijing's data control, and new additions to the entity list.

The Week That’s Done: The Rare Earth Conundrum

February 26, 2023Australian rare earth miner Lynas hits roadblocks in Malaysia, just as the red carpet is rolled out for its Chinese competitors. Meanwhile, battery giant CATL wants to lock in business with cut-rate prices—but only to select EV makers. Plus, natural gas prices tumble and a manufacturing slowdown in Japan.

Deglobalization Round-Up: February 25

February 25, 2023The Kyocera president says that China is "no longer viable" as the world's factory, as developments in rare earths and semiconductors underscore the point. Plus, China looks further to shore up dependencies on chips, foreign auditors and the US sets up a "Disruptive Technology Strike Force."

The Week That’s Done: February 19

February 19, 2023Ford and CATL are teaming up to build a EV battery factory in the US, and it's a new lightning rod for the US-China competition. Europe's gas dilemma remains while the US reasserts itself as the global oil price maker. Plus, another week of a mixed bag of economic data, and US fund manager VanEck might be getting cold feet on China.

Deglobalization Round-Up: February 17

February 17, 2023China bets sink Tiger Global and the Singapore sovereign wealth fund balks at Beijing. Plus semiconductor companies moving out of China, Europe's push for solar, and the "critical-minerals club."

The Week That’s Done: February 12

February 12, 2023Fueled by Chinese demand, Brazil is on pace to tie the US as the world's largest corn exporter. Plus: A natural gas trading hub in Turkey could help Russia circumvent sanctions, China's opening threatens new inflationary pressures, and Pakistan wants a bail-out.

Deglobalization Round-Up: February 10

February 10, 2023Redwood Materials receives a 2 billion USD loan to produce battery materials in the US and the EU doubles down on cutting dependence on foreign energy sources. Plus spy balloon fall-out, aluminum detentions, and outbound investment screening.

The Week That’s Done: February 5

February 5, 2023The EU goes head to head with the US on industrial policy, right when cooperation is most necessary. Plus, BP says that fossil fuels are out but US oil production surges and the world can't kick coal, China's pending export restrictions on solar and rare earth technology, and General Motors pushes ahead with investments in vertical integration. Plus: spy balloon.

Deglobalization Round Up: February 2

February 2, 2023Nucor sees reshoring pushing up demand for it steel and US forgers call for continuing tariffs on China. Plus, Sony moves out of China, Europe's wake-up, the US courts India, and concerns over TuSimple.

The Week That’s Done: January 29

January 29, 2023Copper shortfall and a graphite black swan from China raises questions about future battery supply. Plus, Italy takes steps toward becoming a European energy hub, China's natural gas crunch explained, a multilateral move in chip restrictions on China, and the Maersk-MSC breakup could shake up global shipping.

Deglobalization Round-Up: January 27

January 27, 2023Slumping demand for Chinese goods hits international shipping, Apple moves away from China, and Senate legislation would ban Strategic Petroleum Reserve sales to China. Phoenix Tailings's co-founder, Canada's Minister of Natural Resources, and India's industry minister say they're ready for reshoring.

The Week That’s Done: January 22

January 22, 2023Is US manufacturing in a recession? China’s re-opening puts new strain on commodity markets, Europe rushes to Russian diesel as the oil product import ban nears, and Bolivia picks China’s CATL to develop its lithium salt flats, while the UK’s Britishvolt battery startup collapses. Plus: Bad news for food production and a China-Indonesia wrinkle.

Deglobalization Round-Up: January 19

January 19, 2023Davos might be the symbol of globalization, but even there, the trend toward deglobalization is clear - and MacroFab, GlobalFoundries, and active managers are benefiting (though investors in ByteDance aren't).

The Week That’s Done: January 15

January 15, 2023Wheat futures drop in their steepest weekly plunge since August, but risks remain – while the EU eyes more sanctions on Russian fuel, China eyes Australia’s lithium, and South Korea’s Q Cells eyes a new project in Georgia. Plus: A surprise rare earths find, US-EU tension, and a whole lot more.

Deglobalization Round-Up: January 13

January 13, 2023Will deglobalization be the defining trend of 2023? Moves by Apple, restrictions on Tesla, retaliation from China, and incentives in South Korea all suggest the answer is a strong yes.

The Week That’s Done: January 8

January 8, 2023With China moving on from COVID zero, the energy market looks to tighten – even more. Plus, US LNG exports ramp up, offshore wind energy hits headwinds, and manufacturing contracts, globally.

Deglobalization Round-Up: January 7

January 7, 2023Dell, Panasonic, Denso all rethink dependence on China, while The New York Times covers a turn to Mexico, China threatens retaliation for COVID-19 travel restrictions, and Moscow and Beijing join forces on propaganda.

The Week That’s Done: January 1

January 1, 2023Happy new year – it’s still the same chaotic world: With COVID-19 ravaging China, testing controversy brews and Paxlovid becomes a luxury good. Plus the US job market holds on tight, Russia retaliates over the oil price cap, Japan snaps up global LNG supply, and plastics prices plummet.

Deglobalization Round-Up: December 30

December 30, 2022Is the automotive industry the canary in the coal mine: Major auto makers turn away from China, Tesla shuts down production in Shanghai, BMW and Volkswagen grapple with soaring COVID-19 cases in China. Plus: Customs and Border Production detains goods made with North Korean labor and tensions between Serbia and Kosovo escalate.

The Week That’s Done: December 25

December 25, 2022Geopolitics goes back to basics: Zimbabwe bans lithium exports, the EU imposes a(n easily evaded) gas price cap, China and India snap up cheap Russian fuels, and the US moves forward on a strategic uranium reserve. Plus Myanmar and Russia coordinate on nuclear energy, the Bank of Japan shocks investors, and the US turns to Africa.

Deglobalization Round-Up: December 23

December 23, 2022Stellantis and Apple scale back from China, the Australian sovereign wealth fund projects continuing deglobalization, and Robert Lighthizer calls for strategic decoupling. Plus China increases oversight over cross-border data transfers.

The Week That’s Done: December 18

December 18, 2022New strains hit Europe’s energy systems while the US fights to invest in next generation solutions, and struggles at the upstream. Plus, a breakthrough in nuclear fusion, hope that inflation might be easing (kind of), Japan’s new defense strategy, and more.

Deglobalization Round-Up: December 16

December 16, 2022Redwood Materials announces a 3.5 billion USD recycling and manufacturing campus in South Carolina, while both McKinsey and Bank of America suggest that deglobalization is here to stay. Plus: China takes the US to court.

The Week That’s Done: December 11

December 11, 2022China pivots on Zero COVID as the G7 price cap on Russian oil exports goes into effect. And that’s just one example of a new move to values-aligned trade blocs. Plus: The upward trajectory of lithium battery and tin prices, Russian coal exports, and Germany’s efforts to diversify away from China.

Deglobalization Round-Up: December 9

December 9, 2022The EU sues China at the WTO as Beijing's effort to weaponize globalization come into sharp relief. Meanwhile, are semiconductors the canary in the coal mine for deglobalization?

The Week That’s Done: December 4

December 4, 2022Dampening inflation spurs enthusiasm, but where is the attention to contraction in the US manufacturing index? Plus: A roller coaster week for the growing US-EU trade spat, relaxation in China's COVID Zero restrictions, and a nascent EV industry shift to sodium-ion batteries.

Deglobalization Round-Up: December 2

December 2, 2022Australia prepares to tighten regulations on foreign investment in it critical minerals industry and Canada warns of dependence on unreliable trade partners. Plus former Cisco CEO predicts deglobalization in the tech sector - while Apple's China dilemma and MacroFab's profits prove his point.

The Week That’s Done: November 27

November 27, 2022There’s new progress in the ex-China rare earths supply chain, but is it enough? Plus: Energy turmoil as Europe’s bans on Russian oil and diesel loom; strikes threaten US, South Korean, and UK logistics; China’s back in lockdown; Taiwan has an election surprise; and the OECD summarizes things neatly with a gloomy outlook.

US Manufacturing PMI Data for November Shows Continued Contraction

November 25, 2022S&P Global PMI data, released November 23, showed continued contraction in the US manufacturing sector. The preliminary S&P Global US Manufacturing PMI fell to 47.6 from 50.4 in October, well below expectations of 50. This marks a 30-month low.

Deglobalization Round-Up: November 25

November 25, 2022Bill Ackman calls deglobalization a long-term structural tend, The Financial Times investigates it as a necessity for future prosperity, and growing contradiction between the US and Chinese business environments underscore its inevitability. Plus: Violence at Apple's main Chinese iPhone-making plant, continued supply chain disruption, and an opportunity for Mexico.

The Week That’s Done: November 20

November 20, 2022In the Indonesian new energy industry, the west risks financing China’s profit, and control. Plus, in factors: Enel builds a US solar panel plant; lithium stays hot; and the price cap on Russian oil nears. In markets: LNG prices resist demand, Japan’s economy shrinks, the UK does austerity – while stray missiles threaten to disrupt it all.

Deglobalization Round-Up: November 18

November 18, 2022A Congressional commission calls for revoking China's normal trade status, investors balk on China, friendshoring goes mainstream, and Ford champions a return to in-house production – while MAC Automation Concepts and Code Corporation in the US; Brandauer and In-Comm Training in the UK take action.

The Week That’s Done: November 13

November 13, 2022The EU’s ban on Russian petroleum products is a mere weeks away, winter looms, and the energy crisis is a global affair – with developing economies on the frontlines. Plus, deflation in China, competition in major metal exchanges, and the neon market heats up while palm oil cools.

Deglobalization Round-Up: November 11

November 11, 2022A week in deglobalization: A milestone for US-based foundry Skywater, the American Chamber of Commerce in Shanghai sees US companies turning away from China, Apple's reality shows why, and Kellog and Aalberts report continuing supply chain challenges.

The Week That’s Done: November 6

November 6, 2022Beijing completes its space station and we benchmark the US-China space race – while the Fed keeps hiking, Maersk adds to recession fears, the Black Sea grain deal falters, and Canada orders Chinese lithium companies to divest. Plus: an OPEC for battery minerals?

Deglobalization Round-Up: November 4

November 4, 2022A week in deglobalization: Apple adds new production in India, Canada orders Chinese companies to divest, Bright Machines raises $132 million, Maersk warns of continued price pressures on supply chains, and Deloitte sees reshoring picking up steam.

The Week That’s Done: October 30

October 30, 2022US critical mineral capacity remains critically inadequate, China buys up Indonesia’s cobalt, and what are the prospects for made in USA uranium? Plus, US GDP grows, but pain under the surface, tech players crumble, and manufacturing stalls.

Deglobalization Round-Up: October 28

October 28, 2022A week in deglobalization: Japanese companies seek ex-China production, Motion Control Robotics breaks ground in Ohio, Mexican industrial real estate prepares to boom, GE faces supply chain snarls, and Bloomberg opinion calls for friendshoring.

US Manufacturing Stalls in October

October 26, 2022S&P Global PMI data, released October 24, showed a near-stalled US manufacturing sector. The preliminary S&P Global US Manufacturing PMI fell to 49.9 from 52 in September, well below expectations of 51.2. The decline in US manufacturing activity -- driven by inflation, a strengthening dollar, and earlier stockpiling -- is expected to accelerate.

The Week That’s Done: October 23

October 23, 2022Washington announces another SPR release – amid dropping US crude production, tightening Russia-China-Saudi Arabia oil nexus, and a new oil supply shock on the horizon. Plus, false flag in copper prices, Chinese infrastructure, a skittish yen, and food concerns.

The Week That’s Done: October 16

October 16, 2022The international market is increasingly bifurcated and in the West, the dominant theme is shortage: Aluminum crunch, refining crunch, wheat crunch, freight crunch, LNG crunch narrowly avoided – for now. Plus, in markets, inflation persists; debt risks brew among emerging economies; and Germany's trade surplus shrinks.

The Week That’s Done: October 9

October 9, 2022OPEC explicitly snubs Washington and the West, showing that productive beats consumptive power. Also not brilliant: US monetary tightening is cooling the economy, but in all the wrong places – and that ups recession risks. Plus: Maize malaise in Europe, the Mississippi’s dry spell, a US industrial policy stumble in lithium, and plunging global FX reserves.

The Week That’s Done: October 2

October 2, 2022Poll results show that the US public backs revoking China’s PNTR status and markets should take heed. Plus: Nord Stream sabotage, the LME considers banning Russian metals, Chinese battery and EV firms are snapping up global lithium supply, and the US needs to step up gas production.

The Week That’s Done: September 25

September 25, 2022Beijing plays both sides of today’s energy war, while expanding its influence over tomorrow’s markets. Meanwhile, European industry falters and the UK falters, generally; the Fed ups the ante but Beijing and Tokyo continue to sit this round out; and is copper the bargain of the moment?

The Week That’s Done: September 18

September 18, 2022Inflation is up and FedEx is down: US economic indicators have alarm bells ringing – while Latin America faces triple digit inflation and energy crisis pushes Europe to full-on intervention. Plus: Tesla walks the US-China tightrope; coal prices soar while oil production drops, and a decision point nears for metals markets.

The Week That’s Done: September 11

September 11, 2022A deep dive into Europe’s energy crisis shows faltering industry and political fault-lines, no end in sight for Moscow’s economic warfare, and Beijing as the real winner – plus Europe intent on doubling down on its own mistakes. In markets, a weak currency could strengthen China’s hand, elsewhere it’s hikes hikes hikes, and will India join a major global bond index?

The Week That’s Done: September 4

September 4, 2022Water crisis in Jackson hammers home the national infrastructure plight. Plus: The yen continues to slide and global bonds enter bear market territory; Pakistan and Sri Lanka secure IMF loans while Russia wreaks energy market havoc (price cap be damned); new battery plants and chip export restrictions in the US suggest industrial policy at work – but is it working?

The Week That’s Done: August 28

August 28, 2022Moscow toys with global energy markets and LNG prices surge – with second-order consequences for Beijing’s international influence, global food supply, US inflation. Plus: Drought compounds agricultural crisis, the SPR sits at its lowest level since 1985, Japan eyes nuclear, and China launches a new wave of stimulus. And, of course, Powell says tighten your seatbelts.

The Week That’s Done: August 21

August 21, 2022Record temperature shut down China and squeeze Europe - not the heat the global economy needs. Plus the Chinese central bank cuts rates while UK inflation hits 10.1%, copper miners stay optimistic and the IRA gives them reason, and nuclear fears in Ukraine. Happy weekend!

The Week That’s Done: August 14

August 14, 2022The CHIPS Act is a carrot and Manchin's EV sourcing requirements a stick: US industrial competition could be ready for a comeback - if the private sector is on board. Plus: The energy scramble continues while Turkey plays metals middleman; US inflation relaxes, but so does productivity; and China flexes its delisting muscles

The Week That’s Done: August 7

August 7, 2022Across wheat, gas, steel, the shortage crisis has calmed - but (largely) because of dropping demand, not rising supply. With manufacturing slumping, future food production threatened, buffer eroded, what happens next? Plus: Storm clouds gather in the UK and China throws a temper tantrum.

The Week That’s Done: July 31

July 31, 2022Rare movement in DC offers a glimmer of hope for industrial investment – or at least a signal to the private sector. The bad news: This challenge is above government's pay grade; recession (word choice be damned) looms, and not just in the US; everywhere from energy to grain to space, Russia is adeptly playing spoiler. Plus: scandium, tritium, fixed-price forward contracts, and more.

The Week That’s Done: July 24

July 24, 2022The EU's twin energy and economic crises threaten the bloc's cohesion, also political losses on those struggling to hold it together. Plus: Inflationary pressures mean no tariffs on Russian fertilizer, dumping be damned; the EV revolution strengthens China's auto hand; monkeypox is a global health emergency; and more fun fun fun.

The Week That’s Done: July 17

July 17, 2022Inflation hits a whopping 9.1, but if anything the supply picture is getting worse: Peloton gives up on production, Intel stalls in Ohio, the Texas grid sputters, and Biden strikes out with MBS. Plus: Europe might be headed for shut off, China is gobbling up lithium, and there’s political chaos on the horizon.

The Week That’s Done: July 10

July 10, 2022From disruption in personality politics to cascading social (and economic) disruption, this week has it all. Plus, natural gas soars even if oil shows relief; China doubles down on lithium; dollar-euro parity nears; and the US continues to waffle on tariffs.

The Week That’s Done: July 3

July 3, 2022The good news: It's a long weekend. The bad: California can't figure out supply and demand, US manufacturing is slowing, and the G7's price cap scheme doesn't mean much. Plus: Things look even worse in Europe, copper's drop might just be a blip, will the chemical industry move to China?

The Week That’s Done: June 26

June 26, 2022With the energy crisis here to stay, the White House is throwing Econ 100 to the winds; Europe on a quest for new supply; and China sitting pretty atop cheap Russian imports that promise new energy influence, and leverage over the West. Meanwhile we round out the week with economic collapse in Sri Lanka, a COVID pill in China, and a looming critical mineral shortage.

The Week That’s Done: June 19

June 20, 2022Washington brings supply-side tools to a demand-side fight; the EU fares no better. Meanwhile Moscow turns off gas to Europe while Beijing continues to snipe chip tech. Plus: All eyes on Xinjiang, the Yen, and the WTO's pyrrhic victory.

The Week That’s Done: June 12

June 12, 2022Gas prices hit all-time highs as inflation gallops ahead; Washington relaxes solar tariffs while playing softball with Russia's plunder; plus China stocks make (minor) gains, BYD makes bigger gains, and TSX launches a battery metals index

The Week That’s Done: June 5

June 5, 2022The EU promises that it will block most Russian oil imports maybe – all while production continues to stall and Australia offers worrying indicators of shortage ahead; plus we have European inflation, car companies as space companies, and a pyrrhic victory for the US.

Factors and Markets Briefing: Week of May 23

May 29, 2022With record gas prices, squeezed agricultural producers, and stubborn labor crisis, the era of shortage is here to stay -- and likely worsen. Cue shifting consumer habits, Sri Lanka's default, and a move toward industrial integration (anti-trust be damned). Happy Memorial Day!

Markets Briefing: Week of May 16

May 22, 2022US stocks hit their longest losing streak since the Great Depression – while continuing lockdowns in China, energy dilemmas in Europe, and a continuing failure to invest in domestic production suggest that a reversal of fortune is not on the horizon

Factors Briefing: Week of May 16

May 21, 2022In a new era of shortage, adjustments are being made: Food nationalism rears its head in India, while in critical minerals automakers look to platinum over palladium; meanwhile, the US fails to incentivize greater oil and gas production while China scoops up Russia's at bargain basement prices

Markets Briefing: Week of May 9

May 15, 2022Against a backdrop of staggering inflation, it's general chaos: Crypto crashes, alongside the stock market; dependence on China freezes the US solar industry; the Hong Kong dollar's peg to the USD faces a squeeze; and somehow we're in a perfect storm of inflation, capital market collapse, and great power competition.

Factors Briefing: Week of May 9

May 14, 2022It's shortage everywhere: In agriculture, wheat is the latest victim, threatening tomorrow's food supply while a baby formula shortage wreaks havoc today; meanwhile, China eyes the aluminum vacuum and a South Korea x Canada collab tries to shore up tungsten dependencies.

Factors Briefing: Week of May 2

May 8, 2022India and China double down on coal as the global energy squeeze intensifies – and while Russian alumina supply dwindles; European automakers seek European rare earths supply, and kind of succeed; Malaysia makes moves to fill the cooking oil vacuum

Markets Briefing: Week of May 2

May 7, 2022As inflation soars, the Fed tightens the screws – and markets balk; the real economy weathers the storm better than most; both government and private sector double down on EV supply chains.

Factors Briefing: Week of April 25

May 2, 2022With the Ukraine war disrupting global cooking oil supply, Indonesia decides to up the stakes; new challenges to Russia's lithium supply provide a cautionary tale for the West (or should); and Chinese conglomerates prepare to gobble up Shell's stake in a Russian LNG project

Markets Briefing: Week of April 25

April 30, 2022Ping'an advises HSBC to split into an east and west operation -- which sounds like decoupling but could be the opposite; commodities markets wrestle with a liquidity squeeze; the EU steps up (kind of) for Lithuania amid trade dispute with China, and China continues to find loopholes in US trade regulations

Factors Briefing: Week of April 18

April 24, 2022Indonesia works to climb the nickel value chain while Mexico nationalizes its lithium reserves; fertilizer shortage injects new, cross-cutting threats into the global food market; and nuclear energy comes back into favor -- but how to source the uranium?

Markets Briefing: Week of April 18

April 23, 2022With recession alarms blaring, supply-side solutions remain elusive; the world writes off streaming even as Netflix's revenue grows; Chinese companies target European listings; and the Dutch bet big on photonics while the US-South Korea battery alliance hits rocky waters.

Factors Briefing: Week of April 11

April 17, 2022Amid soaring inflation, the specter of global food shortage; the titanium crunch throws aerospace companies for a loop; Elon Musk weighs tossing his hat into the mining ring

Markets Briefing: Week of April 11

April 16, 2022China's CNOOC grows wary of the US, but not of a global footprint; GM and Glencore announce a flashy new supply partnership; and Beijing signals that there's more intervention in capital markets ahead.

Factors Briefing: Week of April 4

April 9, 2022The global helium shortage puts chaos on the forecast -- and so does the EU's ban on Russian coal; China regains control of a major cobalt mine in the DRC

Markets Briefing: Week of April 4

April 8, 2022Canada wakes up -- kind of, and slowly -- to the risks of foreign investment in strategic areas; elsewhere, it's EVs, EVs, and EVs, but without commensurate attention to the upstream

Markets Briefing: Week of March 28

April 2, 2022The EU makes a long-shot bid for gas market leverage; the Commerce Department wises up to China's solar tariff circumvention; and China's Securities Regulatory Commission looks to cozy up to the SEC

Factors Briefing: Week of March 28

April 1, 2022The Biden Administration's SPR release fails to address supply gaps -- but invocation of the Defense Production Act for critical minerals maybe does; Canada's abundant resource supply pushes it to the big stage in a new geopolitical environment

Your March 25 Briefing

March 25, 2022Moscow teases decoupling, the London Metal Exchange braces for defaults, and the US faces an LNG squeeze.

Your March 18 Briefing

March 18, 2022Markets sour on China -- but don't really; the world trudges toward global food shortage; Europe's rare earths efforts risk finding themselves back on square one.

Welcome to Force Distance Times

March 1, 2022Welcome to Force Distance Times. We’re a solutions-focused magazine dedicated to industrial dynamism.